The altcoin market cap (ALTCAP) has been decreasing since the beginning of September. However, the bullish structure is still intact and will remain so unless ALTCAP decreases below $110 billion.

Long-Term Support

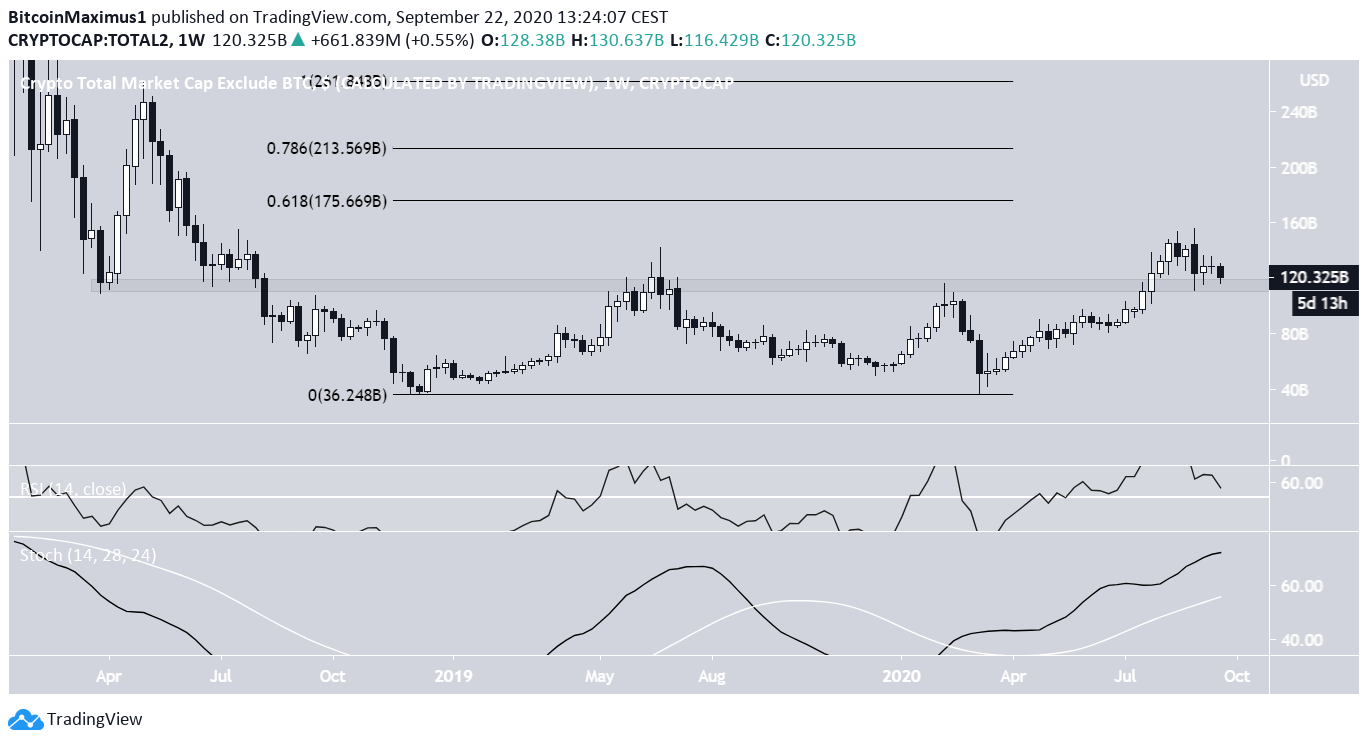

The ALTCAP price has been following an ascending support line since it reached a bottom on March 13. The CAP reached a high of $156.1 billion on Sept. 1 and began to decrease. Despite the decrease, the price is still trading above the ascending support line and the $110 billion support area. If the price manages to hold this level, it could still create a higher low relative to that of the beginning of September, indicating that the trend is still bullish.

Possible Reversal

Technical indicators do not yet suggest a reversal is near. The RSI was rejected at the 50 line and is decreasing. While the MACD was previously moving upwards, yesterday’s decrease also caused a sharp drop. Whether the Stochastic Oscillator makes or rejects a bullish cross, alongside the possible breakdown from the support line will likely determine if the trend is bullish or not.

Wave Count

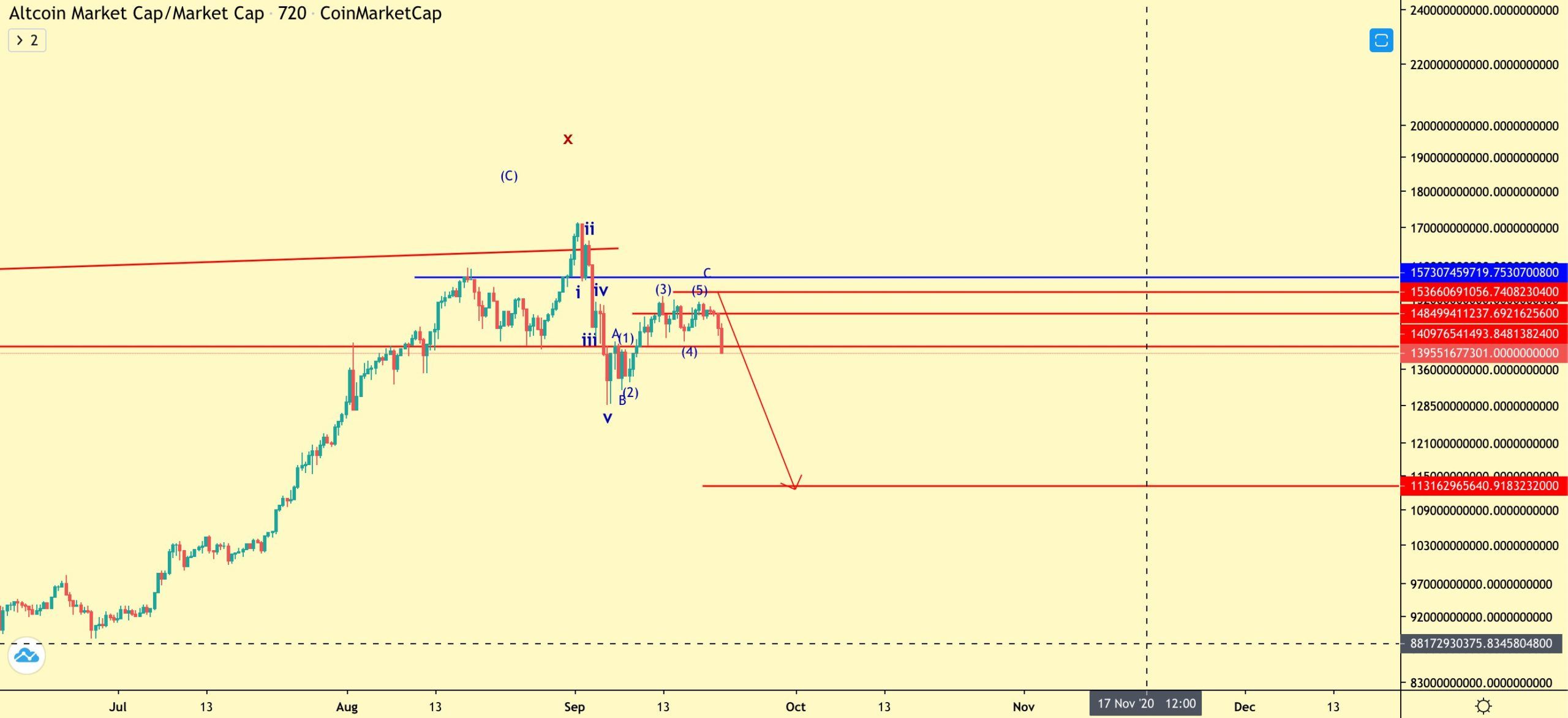

Even though the ALTCAP has been increasing since the beginning of 2019, the movement looks corrective rather than impulsive, possibly taking a complex W-X-Y formation (shown in black below). Furthermore, since the 2018 drop, the price has not even reached the 0.382 Fib level at $208 billion, which should be the minimum retracement level even if the movement is corrective. The $208 billion area also offers other Fib confluence, such as the 1.61 length of wave W (black) and 2.21 length of wave A (red), making it a likely level for a top.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored