Following the outcome of a community poll, DEX platform Curve Finance is set to distribute $2,631,601 in fees to its governance token holders.

In May 2020, Curve revealed that it would decentralise its platform. Governance was by means of its governance token, CRV. The company would deliver tokens to users based on how much liquidity they had provided to the protocol since its launch in January 2020.

The distribution announcement, which came on Nov 27, marks a new frontier in the growth of DeFi. It demonstrates the success of a decentralised governance mechanism over a decentralised liquidity farming platform.

Curve’s road To distributed governance

On Aug 24, BeInCrypto reported that Curve’s first governance vote did not go as well as planned. Voters criticized the voting protocol. Effectively as much as 70 percent of total voting power lay with founder Michael Egorov. Curve remained popular in the yield farming space, though, due to its Automated Market Maker (AMM) technology.

Curve launched initially as a decentralised exchange supporting stablecoins and yield farming. It became a highly sought-after DeFi token in August when a community user correctly deployed a CRV token protocol. By popular demand, the protocol was then adopted by the platform.

A week-long voting exercise began on Nov 20. The result of the vote and the subsequent execution of the community decision provide a shot in the arm for the growth of decentralised protocols by demonstrating the practicality of distributed governance.

Voters included 49.75 percent of the total eligible voting pool, with the decision going through unanimously. According to Curve, payment of the fees will occur on Nov 30. Subsequent fees will be remitted weekly to platform governance token holders going forward.

Curve’s burgeoning growth

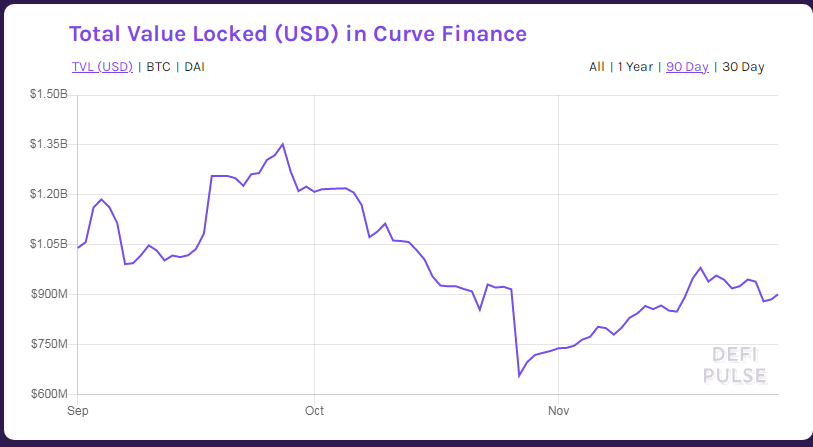

Despite the aforementioned voting protocol teething issues and a significant dropoff in Total Value Locked (TVL) on the platform toward the end of October, Curve has surged in recent weeks. It currently boasts a TVL above $900 million. Curve is the 6th most popular DeFi protocol in existence.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.