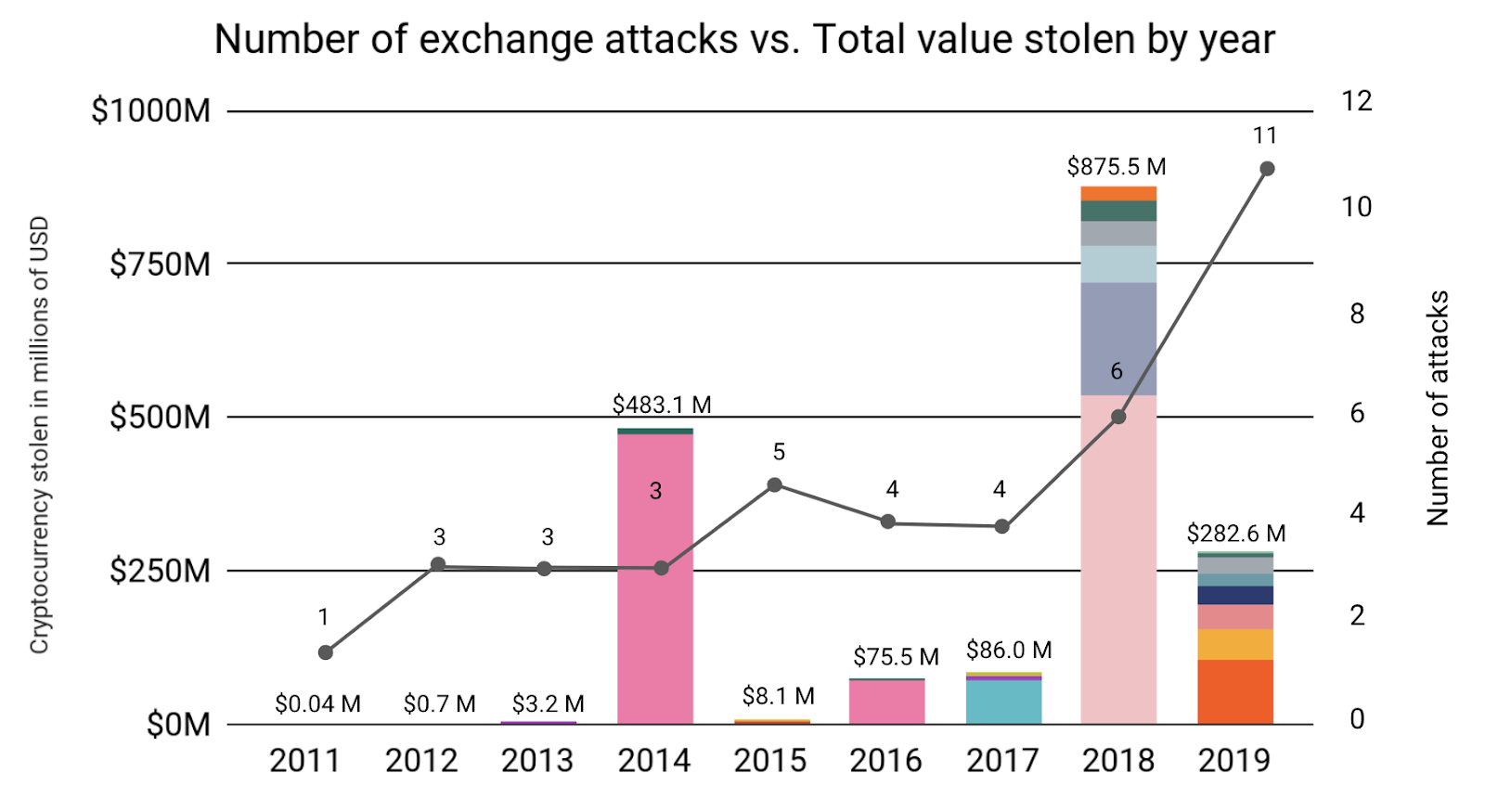

A new report released by blockchain analysis firm, Chainalysis, shows that cryptocurrency exchange hacks in 2019 resulted in a theft of $283 million — a sharp drop from 2018 which saw roughly $875 million stolen. The report also notes that exchanges have strengthened security measures, though some hacking groups have grown more sophisticated as well.

Chainalysis released a condensed version of a soon-to-be-published report that details cybercriminal activity in the blockchain space. The excerpt of the Chainalysis 2020 Crypto Crime Report provides a lot of telling information regarding the evolution of security and attacks in the space.

“Only 54% of the hacks we observed in 2019 took in more than $10 million, compared with all hacks in 2018. While the increase in the number of individual hacks should be concerning, the data indicates that exchanges have gotten better at limiting the damage any one hacker can do.”

Cryptocurrency Hacks Evolving

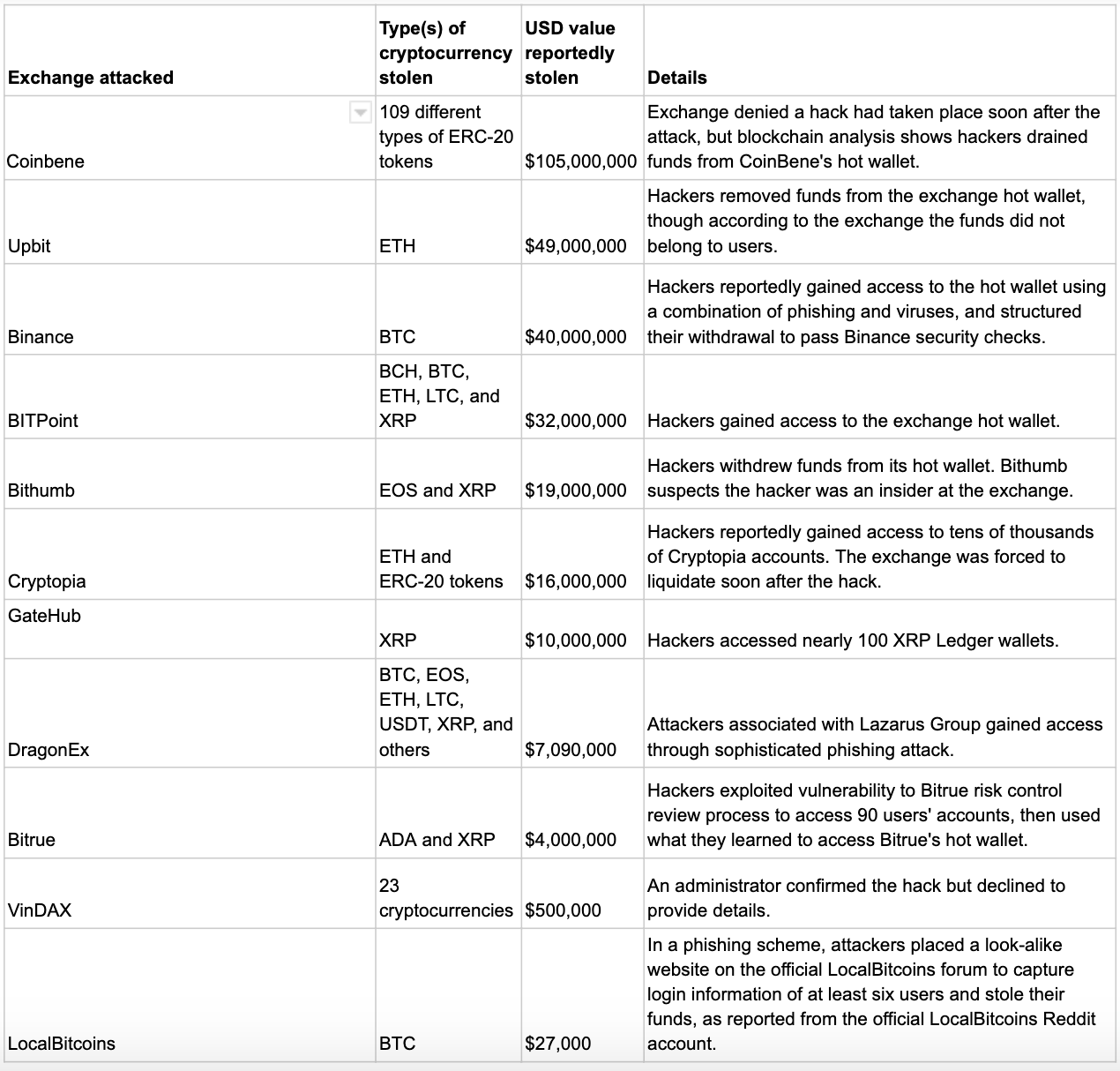

In explaining how it came to these numbers, Chainalysis said that it counted both “technical vulnerabilities and attacks conducted through social engineering or other forms of deception.” It also only focused on attacks related to exchanges, and not entities such as payments processors or wallet providers.

Continued Vigilance is Recommended

While Chainalysis praised exchanges for doing a better job in 2019, it also warns them not to “rest on their laurels” and continue to build improvements to remain secure into the future. Among other things, the report recommends exchanges flagging suspicious transactions before completion and educating employees on how to better protect themselves and the security of their platforms. It also recommends treating large funds moved through mixers or CoinJoin wallets as suspicious, as well as increased cross-border cooperation. The full report is slated for release before the end of the month.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored