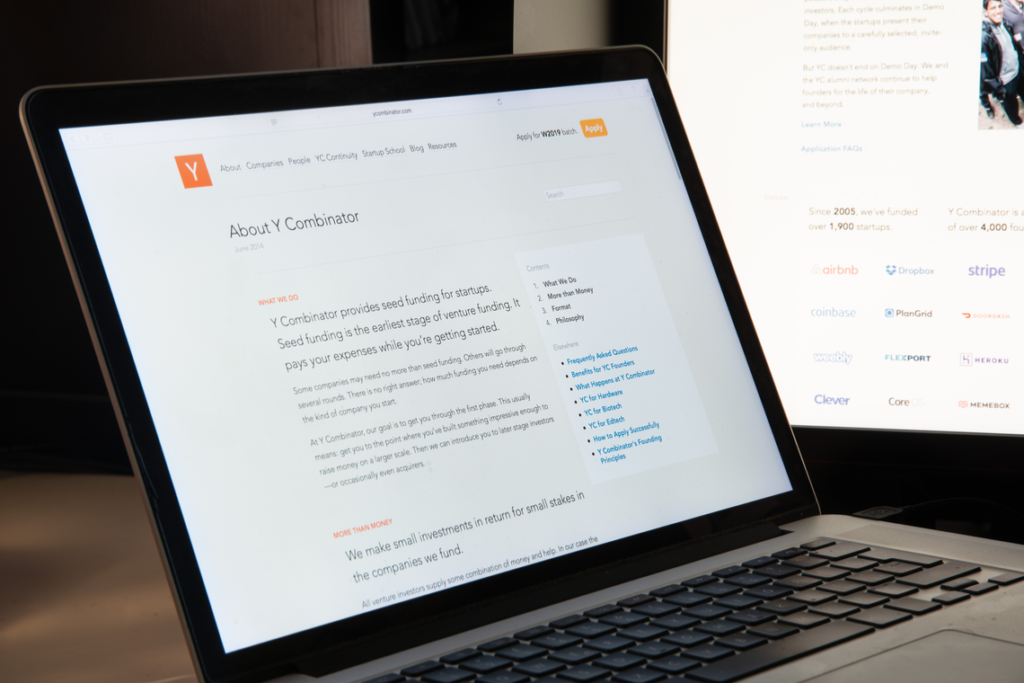

During the summer of 2012, the Coinbase founding team enrolled in the Y Combinator startup incubator program. Investors paid a reported USD($)120,000 for 7 percent equity in the company. On Dec 27, 2018, Vin Armani stated that those shares had reached $560 million — but there is little evidence to confirm these numbers.

Nonetheless, millions of dollars have been invested in Coinbase by various venture capital (VC) firms, financial institutions, and centralized corporations. These investments and the profits made by the investors stand in stark contrast to the theory of decentralization presented by Satoshi Nakamoto. Rather than offering freedom to the users of cryptocurrency, Coinbase has developed into a centralized cryptocurrency exchange that embraces centralized financial institutions.

Coinbase + Y Combinator

Y Combinator is a seed accelerator which currently invests $120,000 of seed money in startup companies in exchange for 7 percent equity. Vin Armani reports that in the summer of 2012, Coinbase was one of the companies to receive seed money from Y Combinator.What is problematic is that the exact amount given to Coinbase cannot be confirmed. Prior to 2014, start-ups received an average of $17,000 with another $80,000 placed in a safe that would become available following the next money raised. The amount of seed money invested by Y Combinator in Coinbase may have been $120,000, but Y Combinator has not formally confirmed this figure. Vin Armani appears to be using figures that would apply only to start-ups in and after 2014.In the Summer of 2012, the investors at @ycombinator paid $120,000 for 7% equity in @Coinbase.

— Ⓥin Ⓐrmani (@vinarmani) December 27, 2018

Six and a half years later, the value of those shares is $560 million.

The next Bitcoin behemoth is as hidden from your view now as Coinbase was to you then.

Seed Money from Venture Capital Firms

What we do know is that a total of $600,00 in seed funding was invested in Coinbase by Y Combinator with the help of several other entities:- IDG Ventures: A private equity company which owns an international series of venture funds

- FundersClub: An online venture capital (VC) firm

- Start Fund: Another VC firm

- Garry Tan: Co-founder and Managing Partner of Initialized Capital, an early stage VC firm

- Greg Kidd: Co-founder of Hard Yaka, a VC firm which invests in exchange space startups

- Adam Draper: Co-founder and managing director of Boost VC, a VC firm which invests in Sci-Fi based projects

Coinbase Controversies

This is just one of many controversies currently plaguing Coinbase. On Dec 7, MANA, LOOM, DNT, and CIVIC were added to Coinbase Pro. Collusion between CIVIC and Coinbase was revealed as a possible motivation for CIVIC’s inclusion. Major investments into MANA and ZEC, a coin earlier added to Coinbase, were made by the Digital Currency Group (DGC). DGC is a major Coinbase shareholder. Furthermore, DNT is listed as a partner of the Decentraland (MANA) project. Coinbase has failed to live up to the theory that decentralized cryptocurrencies should be free from the influence and control of financial institutions and other centralized economic entities. On the contrary, it has relied on financial institutions, VC firms, and publically traded corporations to reach its current valuation of over $8 billion. In addition, Coinbase is a centralized company hosting a centralized cryptocurrency exchange. As a result, its ability to increase profits for centralized economic entities while engaging in possible acts of collusion appears to be very real. Do you think that Coinbase is a trustworthy cryptocurrency exchange or is it putting the interests of centralized financial institutions and VC firms above those of the people using its service? Let us know your thoughts in the comments below!

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored