Bitcoin (BTC) has broken out from a short-term descending parallel channel.

Ethereum (ETH) and XRP (XRP) are following descending resistance lines.

Stellar (XLM) trades just below resistance, while XEM (XEM) has bounced at support.

Chainlink (LINK) & Cosmos (ATOM) are trading inside symmetrical triangles.

Bitcoin (BTC)

BTC has finally managed to break out from a descending channel that had been in place since March 12. This confirms that the previous correction has now ended.

There is minor resistance at $59,500, which could cause a short-term rejection.

In any case, both long- and short-term technical indicators are bullish, and so is the wave count. BTC is expected to reach a new all-time high price.

Ethereum (ETH)

ETH has been following a descending resistance line since reaching an all-time high price of $2036 on Feb. 20.

It has been decreasing since, following a descending resistance line. Currently, it is trading just below this line.

Technical indicators look bullish, and ETH has reclaimed the $1680 area, validating it as support. Therefore, it is expected to break out.

For the longer-term count and future movement, click here.

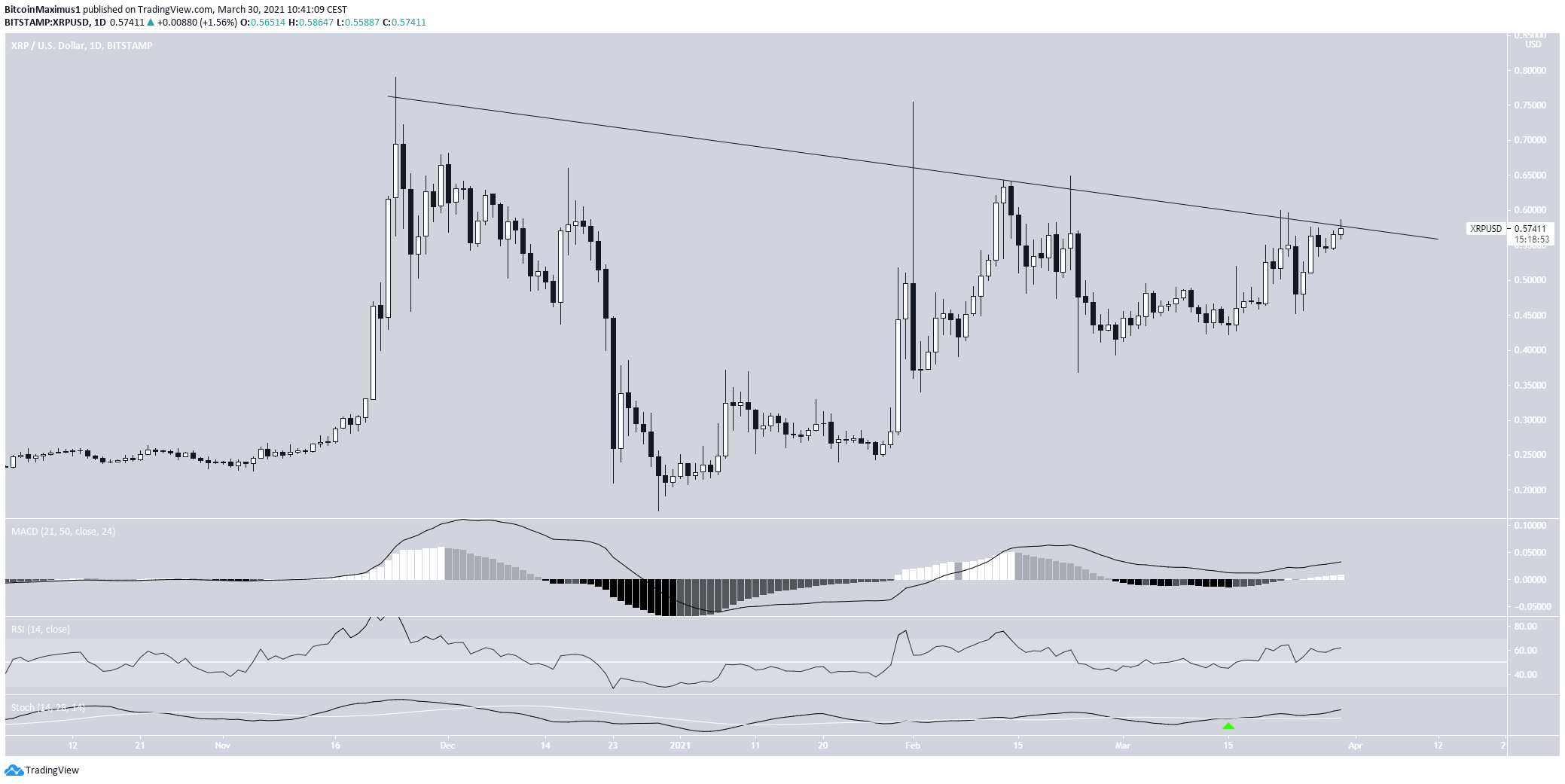

XRP (XRP)

Similar to ETH, XRP is also following a descending resistance line. However, it has been doing so for longer, more specifically since Nov. 2020.

Currently, XRP is making its fourth breakout attempt.

Technical indicators are bullish, indicating that XRP will break out. If so, it could potentially increase all the way to 0.9 and possibly $1.30.

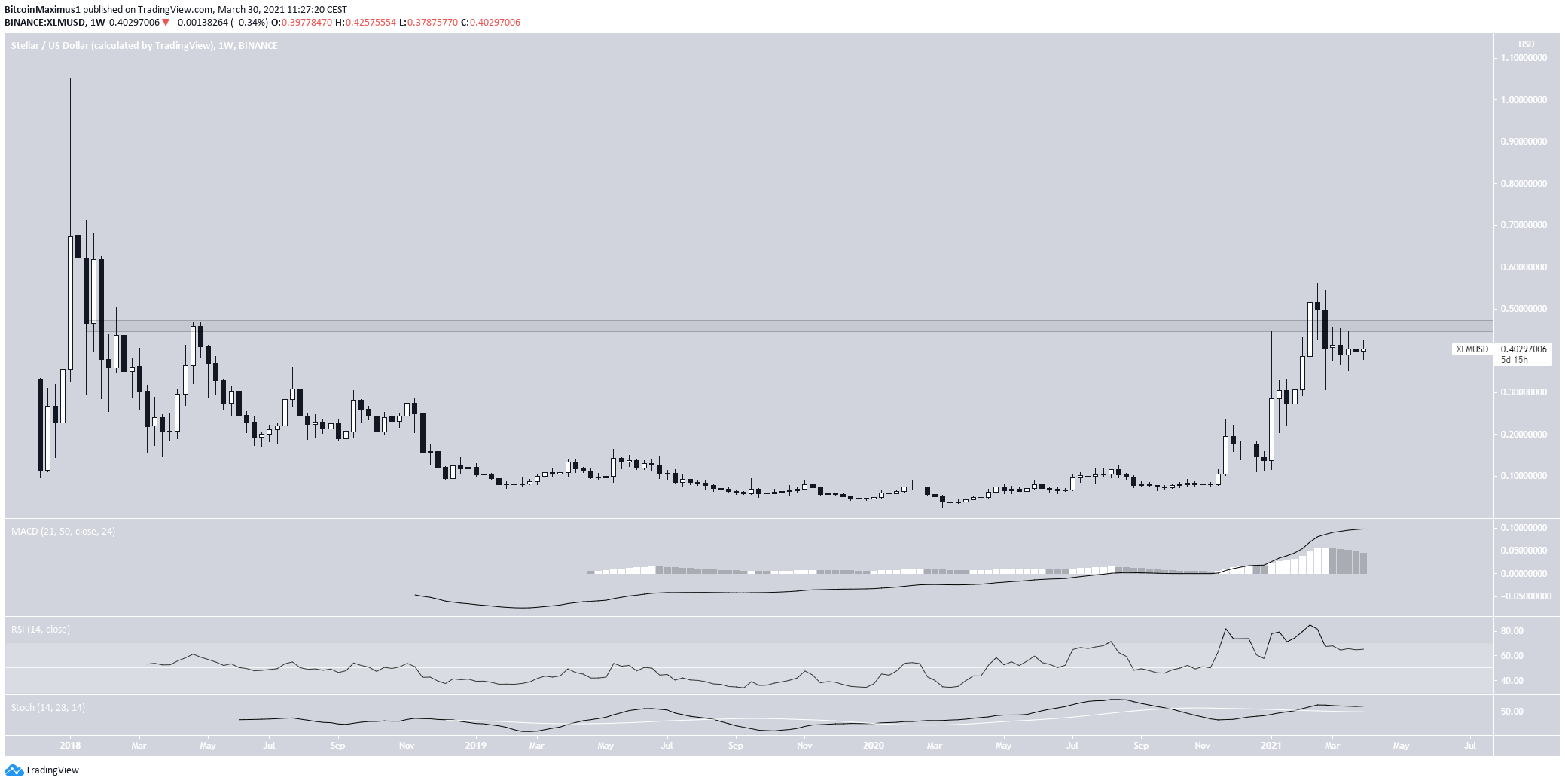

Stellar (XLM)

XLM has been decreasing since Feb. 13, when it reached a high of $0.61. This took it below the $0.46 area, which is now acting as resistance.

Technical indicators are undecided. While the Stochastic oscillator has made a bullish cross, the RSI has fallen below 70.

Therefore, the direction of the trend remains undetermined until XLM gets rejected or breaks out above the $0.46 area.

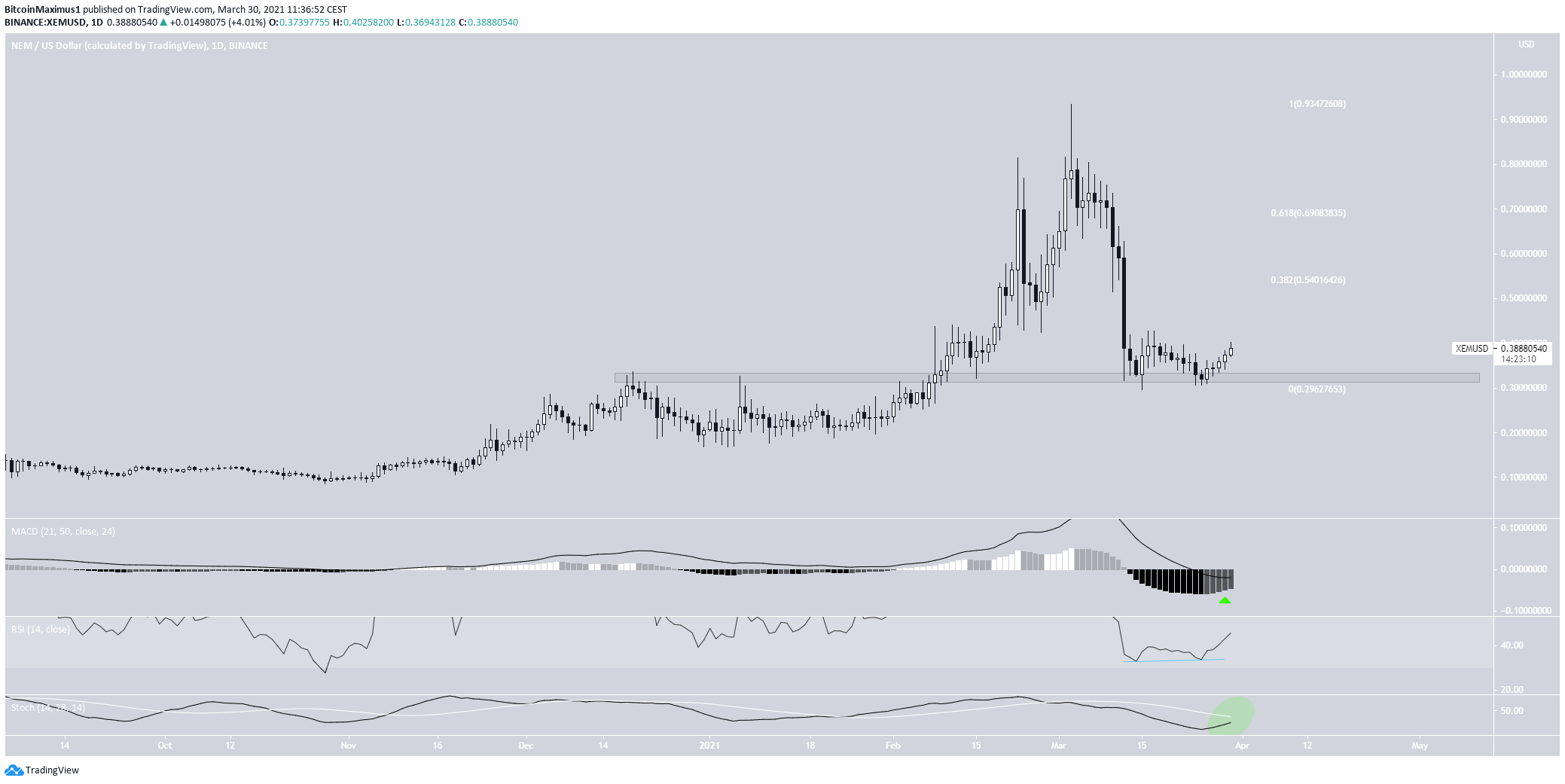

XEM (XEM)

XEM has been moving downwards since March 13, when it reached a high of $0.93. The drop was sharp, taking XEM to the $0.33 support area.

XEM bounced almost immediately afterward, creating a double bottom pattern. Besides being a bullish reversal pattern, it was also combined with a bullish divergence in the RSI. The MACD has also turned bullish, and the Stochastic oscillator is close to doing so.

Therefore, XEM is expected to increase at least towards the $0.54 level and potentially the $0.69 one.

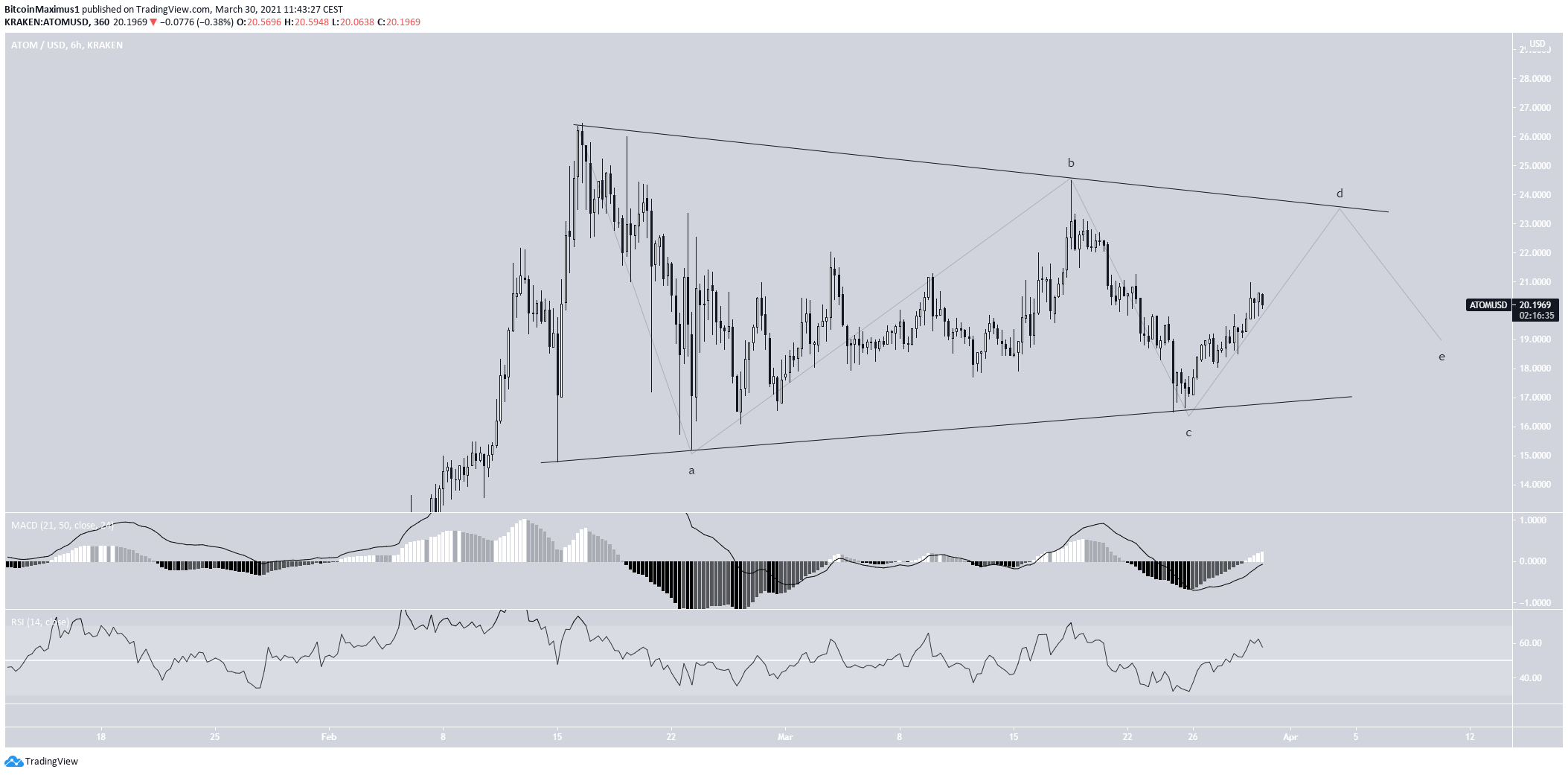

Cosmos (ATOM)

Since Feb. 16, ATOM has been trading inside a symmetrical triangle. This is considered a neutral pattern. However, since it is transpiring after an upward movement, a breakout would be more likely. Technical indicators also support this possibility.

Nevertheless, ATOM would expect another rejection from the resistance line before a breakout.

Chainlink (LINK)

Like ATOM, LINK has also been trading inside a symmetrical triangle, having done so since Feb. 22.

After another potential rejection from the resistance line, LINK is expected to break out. Technical indicators also support this.

For BeInCrypto’s previous bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.