The Bitcoin Dominance Rate (BTCD) has been rejected by the long-term 71.5% resistance area, creating a long upper wick and closing below the area.

The Bitcoin Dominance is expected to decrease toward the 66% support area at least in the short term.

Bitcoin Dominance Long-Term Rejection

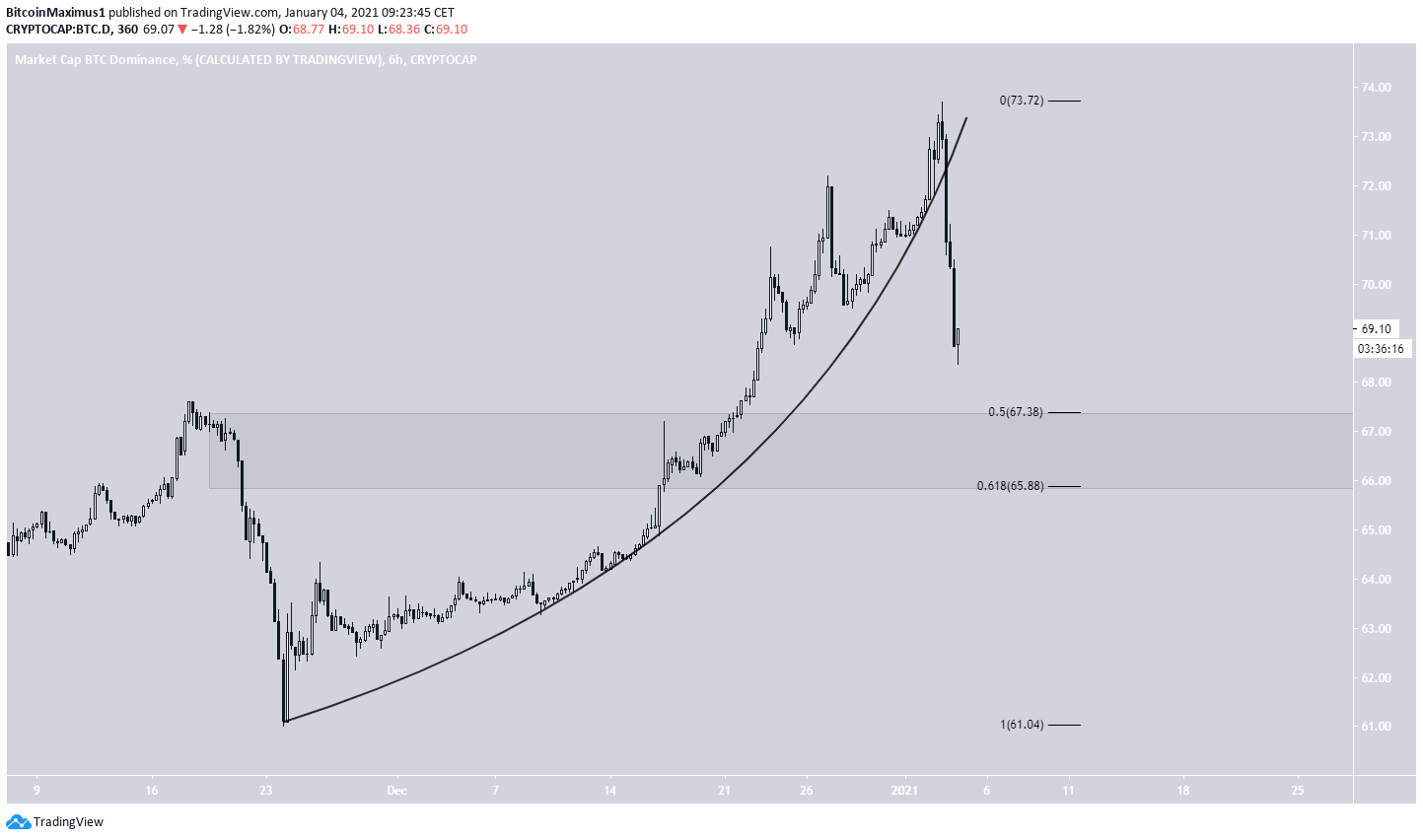

During the week of Dec. 27 – Jan. 4, the BTCD seemingly increased above the 71.5% resistance area, something it had not done since the beginning of 2017.

While BTCD reached a high of 73.63% on Jan. 3, it proceeded to decrease sharply afterward. It left a long upper wick in its wake and closed below the 71.5% resistance area.

Despite the rejection and drop, technical indicators in the weekly time-frame are still bullish, suggesting that BTCD is likely to eventually break out above this level. If it does, the next resistance area would be found at 84%.

Future BTCD Movement

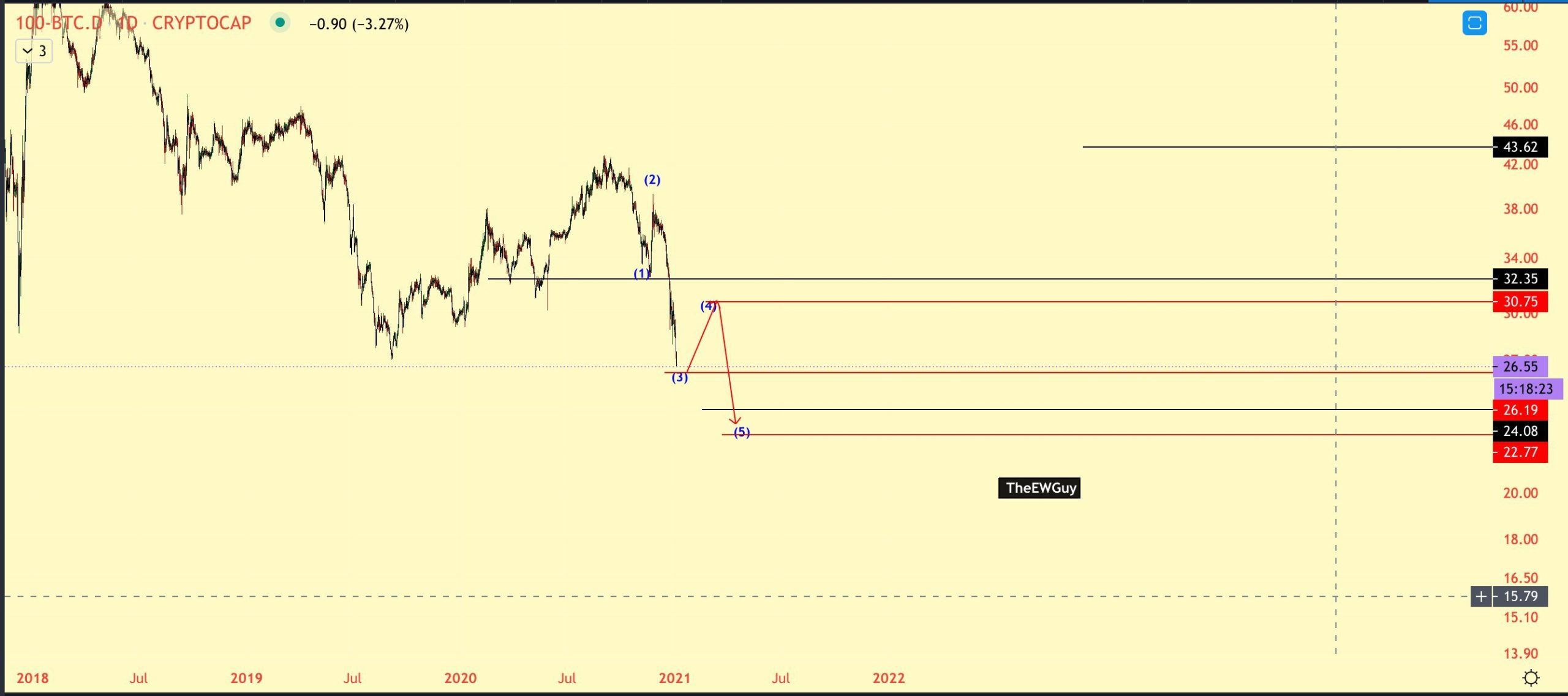

Cryptocurrency trader @TheEWguy outlined a BTCD chart, stating that altcoins are likely to get a relief rally very soon. However, he believes that BTCD will increase again after — giving a target near 78%.

The daily chart shows that BTCD has been following an ascending support line since the upward move started at the beginning of September. The line is currently near 66%.

Unlike the weekly time-frame, there is clear weakness in the daily chart, visible in the form of:

- Bearish divergence in the RSI

- Bearish cross in the Stochastic oscillator

- Lower momentum bar in the MACD

Therefore, BTCD is expected to decrease towards the support line near 66%.

The six-hour chart shows a broken down parabola, and a support area found between 65.88%-67.38% (0.5-0.618 Fib retracement levels), which also coincides with the previously outlined ascending support line.

Therefore, the most likely scenario would be a decrease toward this level before a bounce occurs.

Altcoin Index Perpetual Futures (ALTPERP)

ALTPERP had been decreasing alongside a descending resistance line since reaching a high of $1,226 on Nov. 24. On Jan. 3, the ALTPERP broke out and proceeded to reach a high of $1383 the next day.

However, the current daily candlestick has a long upper wick and depending on the close, could be a shooting star. This is a sign that the ALTPERP could decrease to validate the breakout line or possibly the $1.100 support area.

However, technical indicators are bullish, so ALTPERP is still expected to resume its upward movement afterward.

Conclusion

While the Bitcoin Dominance (BTCD) is expected to decrease in the short-term, it’s possible that the longer-term trend is still bullish.

The Altcoin Index has broken out from a descending resistance line and is expected to continue increasing.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.