On Nov 5, the Bitcoin Dominance Rate (BTCD) was rejected by a descending resistance line that has been in place for more than a year.

The rate is expected to decrease in the short-term before eventually making another attempt at breaking out.

Bitcoin Dominance Rejected from Resistance

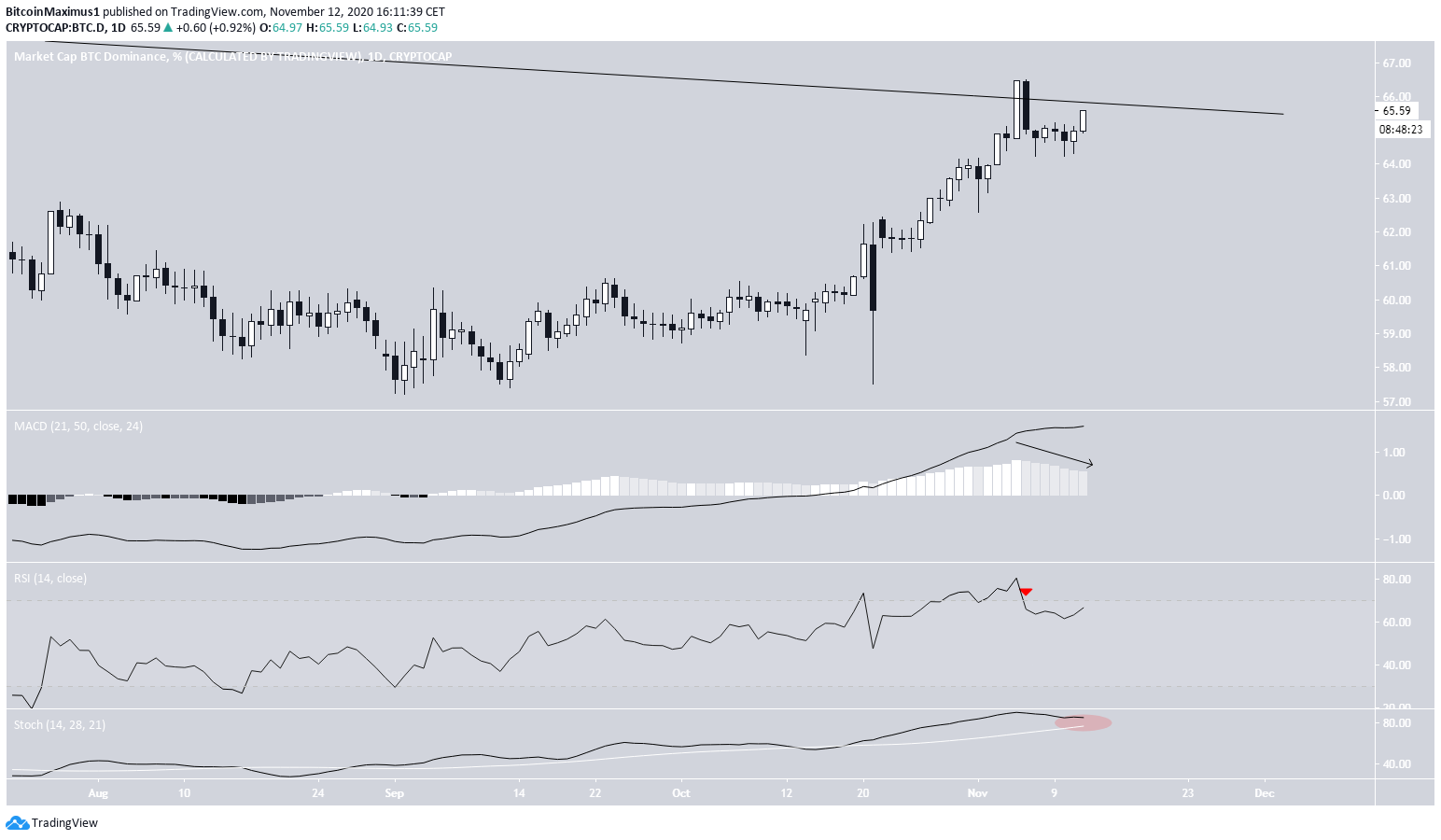

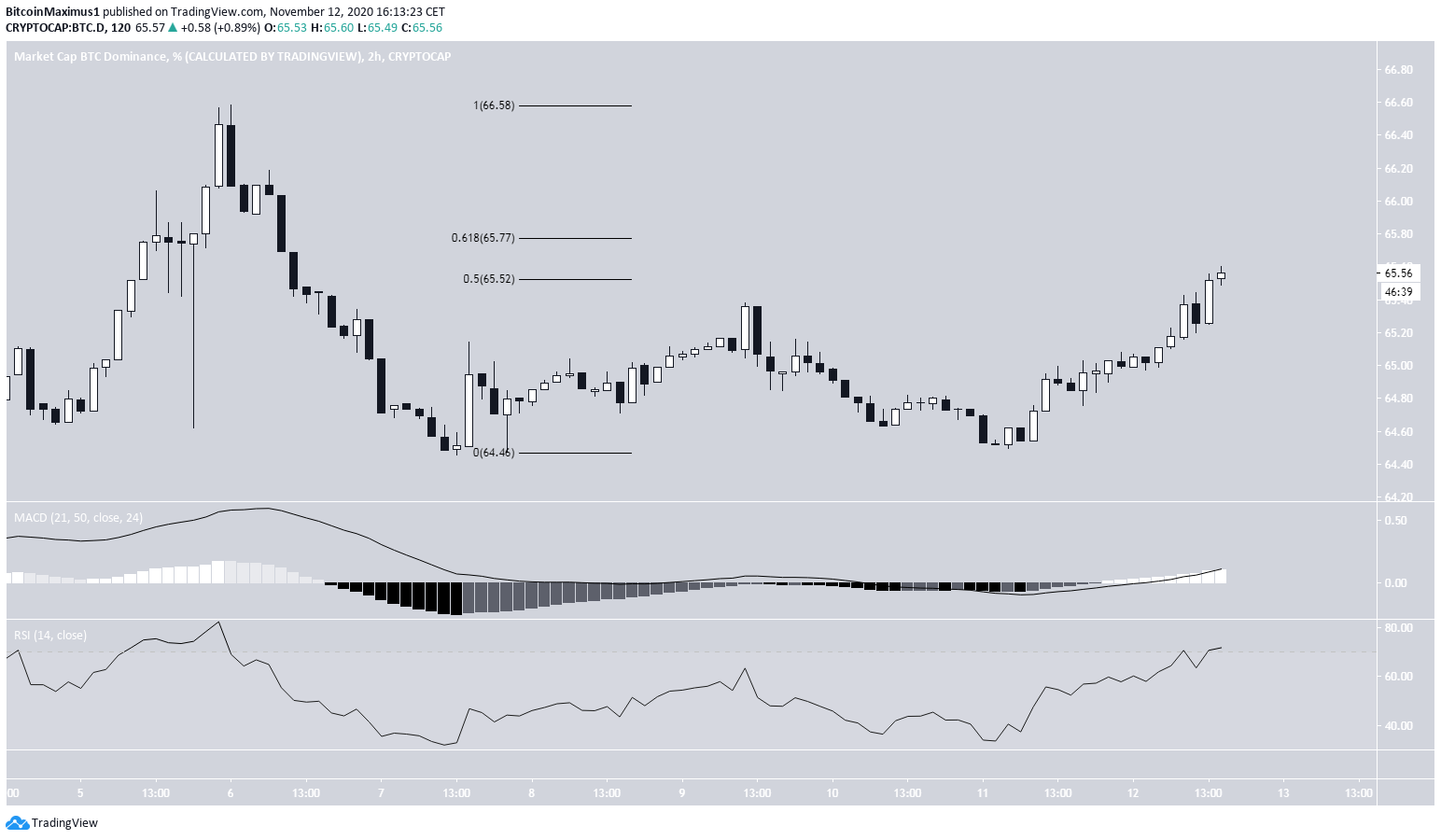

The BTCD rate has been increasing since the beginning of September. The increase continued until reaching a descending resistance line that has been in since July 2019. BTCD reached this line on Nov 5, but was rejected shortly afterward and began the current decrease. The line also coincides with the 66.5% resistance area which is the 0.786 Fib level of the most recent decrease. The closest support is found at 64.5%.

Short-Term BTCD Movement

Technical indicators do not give a clear verdict on the future movement. While the MACD is overbought and the histogram is showing weakness, it has not yet begun to decrease nor has it generated bearish divergence. Similarly, the RSI has begun to decrease, falling down from the overbought region, but has not generated any bearish divergence. Finally, the Stochastic oscillator has yet to make a bearish cross, even though it is moving downwards. Since the price is approaching the resistance line once more, and technical indicators do not show strength, another rejection would be the most likely scenario.

Wave Count

Cryptocurrency trader @TheEWguy outlined a BTCD chart, stating that after a relief rally, an extended downward movement is likely in the cards.

Conclusion

While a short-term retracement could occur, the BTCD is expected to eventually break out from the current descending resistance line and continue moving higher. For BeInCrypto’s latest Bitcoin analysis, click here! Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored