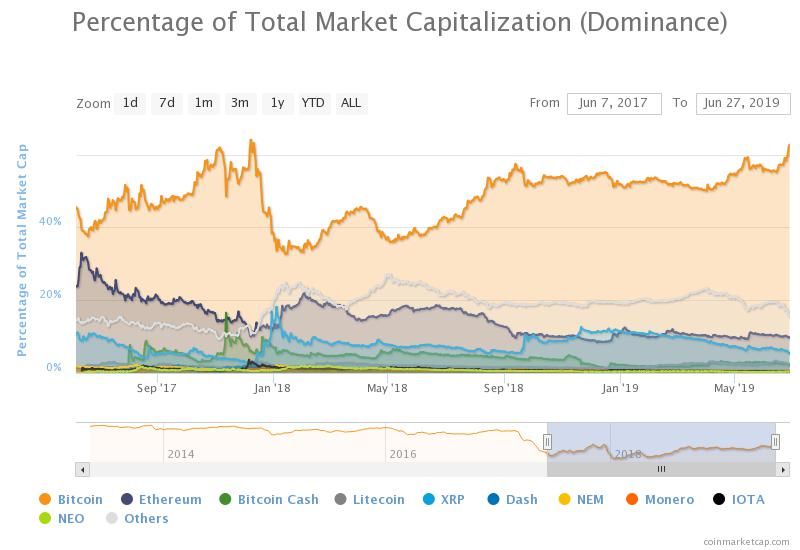

In the above Tweet, Blokland observes that the relative value of the altcoin market is down almost 40 percent this year, alone, versus that of Bitcoin. This has put Bitcoin back up to almost 63 percent dominance — a high not observed since December 2017.#Altcoins are being obliterated by #bitcoin. Down 40% in relative terms just since the beginning of this year. pic.twitter.com/8wupkRZovX

— jeroen blokland (@jsblokland) June 27, 2019

Bitcoin continuing to decouple from (and outperform) altcoins may be an indication of the market maturing.

Civic (CVC) CEO and founder, Vinny Lingham, has argued that there is no good reason for the synchronicity in price moves often observed in the cryptocurrency markets. Earlier this year, he put down his musings on the subject in a Twitter thread:

Bitcoin continuing to decouple from (and outperform) altcoins may be an indication of the market maturing.

Civic (CVC) CEO and founder, Vinny Lingham, has argued that there is no good reason for the synchronicity in price moves often observed in the cryptocurrency markets. Earlier this year, he put down his musings on the subject in a Twitter thread:

In the thread, the South African entrepreneur argues that the fact that almost all crypto assets frequently move in tandem with Bitcoin shows that the market is not sophisticated enough to discern the merits of different projects and remains content to pour money into anything related to blockchain or cryptocurrency. Lingham did speculate that if Bitcoin could pass $6,200, it would likely trigger another massive speculative mania. However, he warned that, if altcoins continued to rise without merit alongside Bitcoin, the situation is “likely not going to end well again.” What do you think? Will there be gains across the altcoin markets like in 2017 or will investors need to be more selective this time around? Let us know what you think in the comments below.Many people believe that the crypto winter is over. Here are some of my unfiltered thoughts on this topic. Charts & technicals aside, I don’t believe this rally is sustainable for one reason: The market has not yet decoupled the various crypto assets from Bitcoin.

— Vinny Lingham (@VinnyLingham) April 10, 2019

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.