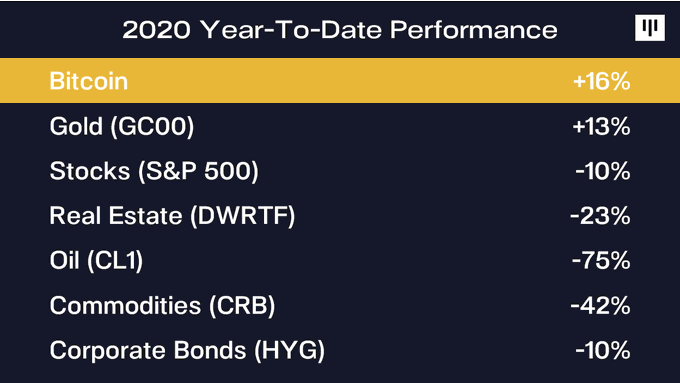

Bitcoin has been named the asset with the highest year-to-date growth in 2020 according to figures released by Pantera Capital. This puts it ahead of assets like gold, oil, and real estate.

Bitcoin enthusiasts have often touted that BTC is the next big investment tool to be used globally, favoring it over traditional investments like gold and stocks. These enthusiasts have reason to celebrate as it was reported on April 29, 2020, by Dan Morehead, Pantera Capital CEO, that the cryptocurrency has surpassed gold in year-to-date performance. Bitcoin has seen 16% growth since Jan 1, 2020, while gold sits at 13%.

#Bitcoin overtakes Gold Year-To-Date. Bitcoin was born in a financial crisis. It will come of age in this one.Bitcoin, and cryptocurrencies in general, have always been compared to traditional investments, particularly during the ongoing COVID-19 outbreak. This has brought up a discussion about whether cryptocurrencies are better investments for times of crisis. In the table posted by Morehead, stocks, oil, and real estate are shown to have negative growth while gold and cryptocurrencies have thrived.

Morehead Has a History of Bitcoin Support

This is not the first time that Dan Morehead has spoken positively about Bitcoin as he seems to be a vocal supporter of the currency. In a recent letter to investors, he stated that Bitcoin would come of age in the aftermath of the 2020 economic crisis and would exceed its all-time price. This is a sentiment that Morehead repeated in his latest tweets about the digital currency. While he has high hopes for Bitcoin, he has made grim predictions about the world economy as a whole. By his account, the incoming global recession will prove worse than anything experienced by the post-World-War world. Back in July 2019, Morehead had predicted that Bitcoin would get to $42,000 by the end of the year and would get to $356,000 a few after.

In an appearance on the Unchained podcast, he also claimed that the technology behind the cryptocurrency would improve to accommodate more users. This optimism did not extend to all tokens though, as he believes that most altcoins will eventually fail.

Back in July 2019, Morehead had predicted that Bitcoin would get to $42,000 by the end of the year and would get to $356,000 a few after.

In an appearance on the Unchained podcast, he also claimed that the technology behind the cryptocurrency would improve to accommodate more users. This optimism did not extend to all tokens though, as he believes that most altcoins will eventually fail.

That put Bitcoin at $42,000 at the end of 2019, which I know sounds crazy, but essentially we’re halfway back there.

Will Bitcoin Come of Age in a Time of Crisis?

The last few months have been interesting for investing and assets as a whole. The COVID-19 outbreak has had a tremendous effect on the global economy, including cryptocurrencies. Some like Morehead have theorized that Bitcoin will mature during this time and secure its place as the investment of choice during uncertainty. Its growth this year despite the outbreak could be a testament to this theory. One of the possible reasons for this is that Bitcoin was conceptualized around the 2008 recession and thus, was built to withstand an economic crisis. Another possibility is that the accessibility of the currency makes it easier to invest in or pull out from during a crisis compared to an asset like real estate.

But not everyone feels this way. Both gold and Bitcoin suffered price slumps in February and March of this year. Gold has since surged, now approaching a seven-year high. Bitcoin, while it has seen some recovery, is nowhere close to a seven-year high. This is often cited by supporters of gold as to why it is the superior investment.

Another possibility is that the accessibility of the currency makes it easier to invest in or pull out from during a crisis compared to an asset like real estate.

But not everyone feels this way. Both gold and Bitcoin suffered price slumps in February and March of this year. Gold has since surged, now approaching a seven-year high. Bitcoin, while it has seen some recovery, is nowhere close to a seven-year high. This is often cited by supporters of gold as to why it is the superior investment.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored