The Bitcoin price increased significantly over the course of the day on March 30. The price opened at $5,880 but created a bullish engulfing candlestick that reached a high of $6,599 and closed at $6,400.

Bitcoin Monthly Candlestick

The Bitcoin candlestick for March has only one more day to reach a close. It would be an understatement to say that the monthly price action was volatile considering that on March 13 the price was a full 58% below its monthly high. However, the current price is now back to 25% below the opening price. The monthly candlestick resembles a bearish hammer, with both a long body and a very long lower wick. While this is s bearish indicator, the price seems to be holding up well above significant monthly support levels found at $6,300. If the price reaches a close above this area, a continuation bullish candlestick would not be ruled out. It is worth mentioning that the current lower wick is the longest since February 2018, indicative of strong buying pressure. Due to its ambiguous signs, we can consider the March candlestick as neutral, leaning on bearish. The next monthly close will likely be extremely helpful in determining the direction of the future trend. A close above $8,000 (the opening price of March) would indicate that the trend is bullish and BTC will move upwards back above $10,000. Conversely, a close below $6,000 would likely cause the price to retest the $3,300 bottom reached in December 2018.

Short-Term Outlook

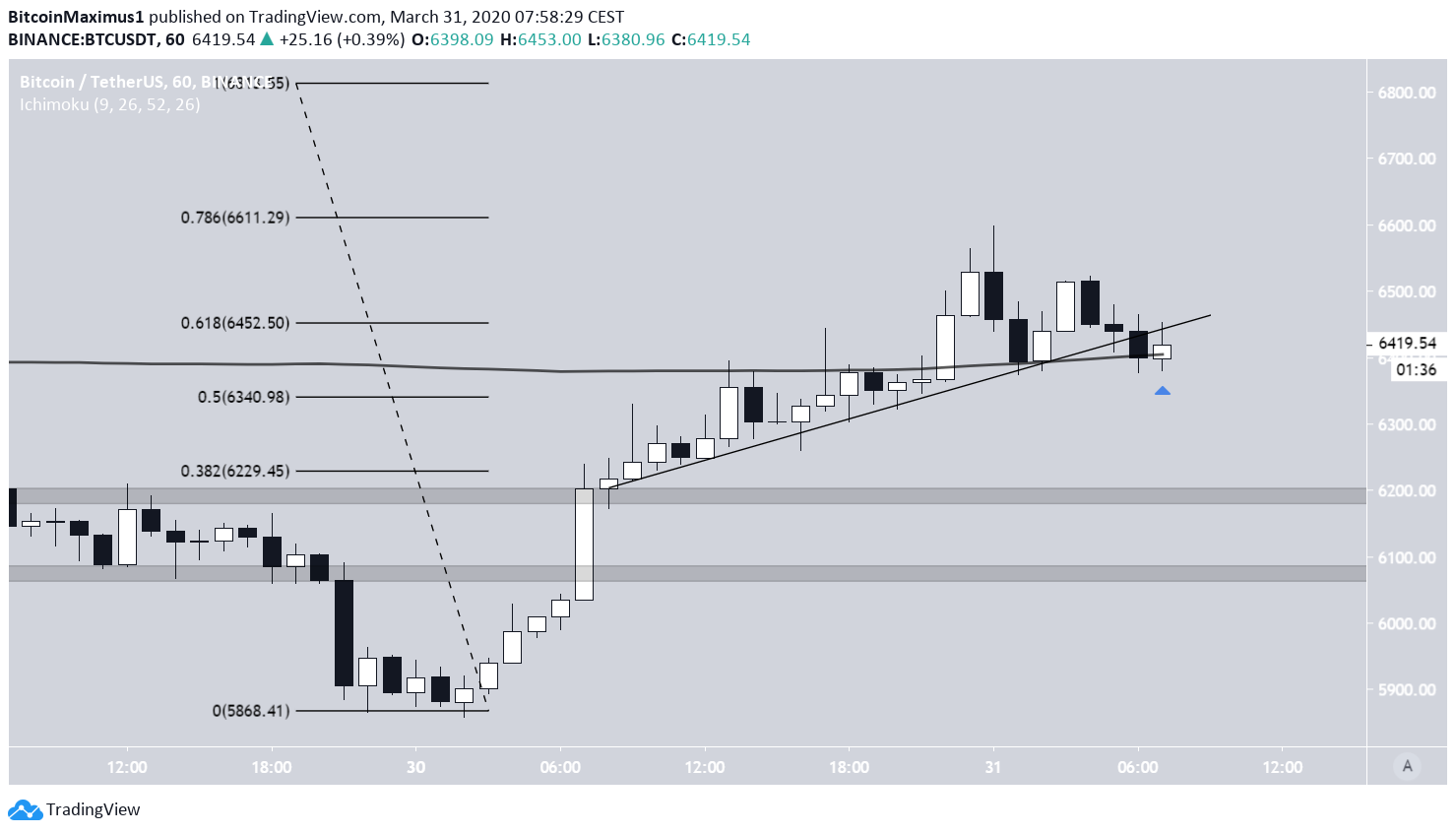

In the short-term, we can see that the increase from the $5,857 bottom has been quite rapid, with the price breaking out above major resistance levels without trouble. The rally initially stalled near $6,400. This is a very important level since it is both the 0.618 Fibonacci level of the entire previous decrease and the 200-hour moving average (MA). Therefore, a breakout above this level and its subsequent validation as support could go a long way in providing a bullish bias. While the price did break out, it found resistance at the next significant Fib level and has been decreasing since. The price is seemingly using the 200-hour MA as support but has broken down below an ascending support line. Therefore, the BTC price is expected to move downwards towards the support areas outlined below, found at $6,200 and $6,050.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored