BeInCrypto takes a look at the reserve risk on-chain indicator and its components, in order to determine if the current Bitcoin (BTC) market conditions are oversold.

What is Bitcoin reserve risk ?

Reserve risk is a cyclical indicator that tracks the risk-reward balance relative to the confidence and conviction of long-term holders. Therefore, when the price is low relative to the confidence, it offers a good risk/reward opportunity.

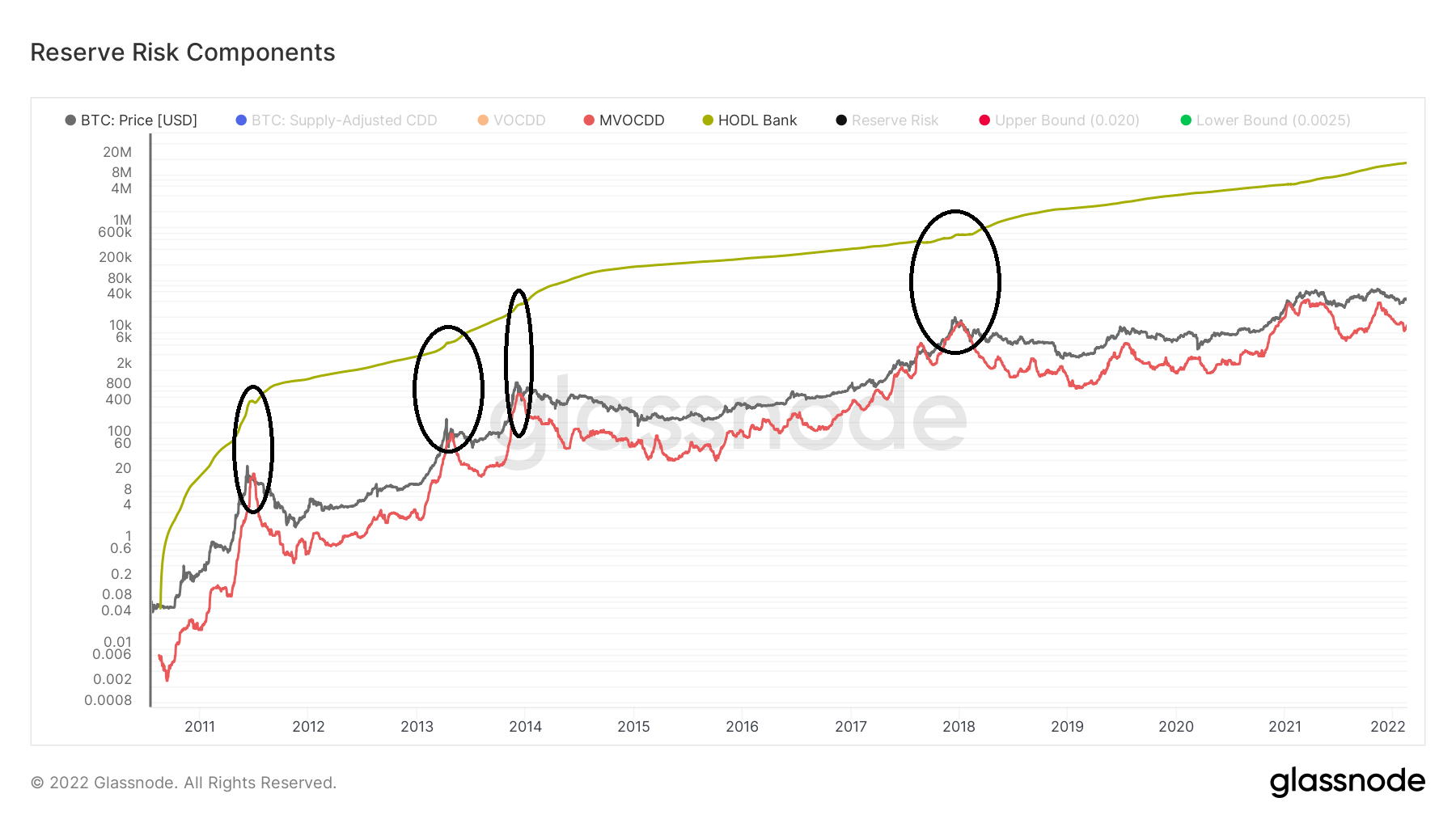

Values below 0.002 are considered oversold (green), while those above 0.02 are considered overbought (red).

Historically, each market cycle top has been reached inside this overbought region. Conversely, bottoms have been reached inside the oversold region.

On Jan 24, Bitcoin reserve risk reached a low of 0.0022 — the lowest value since October 2020.

However, while reserve risk has fallen well into the oversold region, it’s worth mentioning that it has historically stayed in this level for significant periods of time before eventually moving back up.

Components

Each day a coin remains unspent, it gains a coin day, which is then destroyed once the coin is spent. This value correlates to the coin days destroyed (CDD) indicator. As price increases, so does the incentive to sell. Therefore, if CDD does not increase even though the price is increasing, it means that holders have strong conviction and are not realizing profits despite the increase in price.

A slight variation of the CDD indicator is the median value of coin days destroyed (MVOCDD). It multiplies the median value of CDD with the BTC price (grey line). Therefore, when there is a a difference between the price and MVOCDD, it means that the majority of holders are not selling.

The gap between the price and actual spending can be seen as sort of an opportunity cost of not selling. This cumulative opportunity cost is then called the HODL Bank (green). The HODL bank is the denominator of the Reserve Risk indicator.

HODL bank decrease when MVOCDD moves above the BTC price (black circles) but increases when the gap between the two widens.

When we put all these components together with the Reserve risk indicator, it’s clearly visible that the indicator reached the overbought levels when MVOCDD moves above the BTC price. Conversely, it reaches the oversold region whenever there is a considerable gap between MVOCDD and the price.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.