On Feb 1, 2019, Binance Research published a report on Fetch.AI (FET), which hosted a private sale similar to an ICO on Binance Launchpad in 2018. Based on the numbers in the report, a majority of the money raised may have already been spent.

Despite this, FET is still not being traded on any exchange — nor has Fetch released any products or services.

However, an updated roadmap does suggest that there may be major developments throughout 2019. If Fetch is unable to adhere to this roadmap, it may follow a similar path as NEM — which is currently being scrutinized for mismanaging funds in 2018.

Read our in-depth #BinanceResearch report on the latest @Binance Launchpad project @fetch_ai here 👉 https://t.co/TZWblQw3hB pic.twitter.com/ZZb7tmorgE

— Binance Research (@BinanceResearch) February 1, 2019

Red Flags: Sale and Distribution of FET

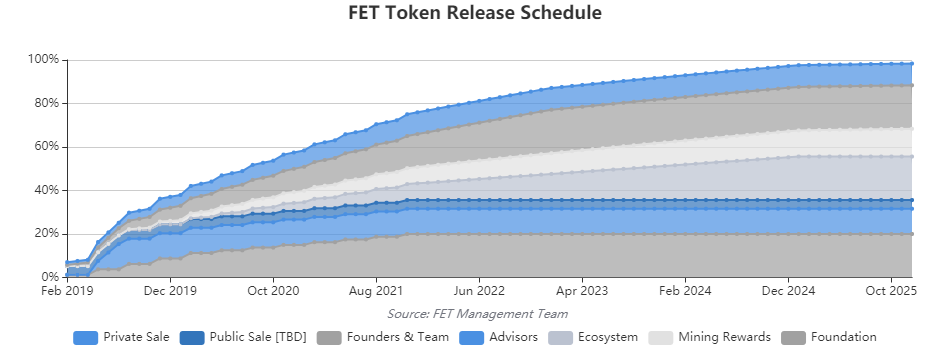

Binance reports that 11.62 percent of the total 1,152,997,575 of FET was sold as part of a private sale on Binance Launchpad in three sessions between April and July 2018. FET has not yet been distributed to the buyers. It was purchased as part of a Simple Agreement for Future Tokens (SAFT) sale. Like a traditional initial coin offering (ICO), the tokens were purchased with the promise that they would be received at a later date. The report states that the distribution of tokens will begin in Feb 2019 when tokens enter into circulation. Not all tokens will enter the market immediately nor has the first exchange FET is expected to be listed on been announced. Binance Research shows that token distribution is not expected to be completed until Oct 2025. Distribution of all tokens should begin at the same time, according to this information. However, public sale tokens cannot currently be distributed. This is because no public sale has taken place. When (or if) the public sale will occur is unknown, though this graph suggests that the public sale must occur in Feb 2019 — so that distribution of all tokens can begin as scheduled.

Mismanagement of Funds?

The report states that FET raised $974,975 and 24,596.5 ether by July 10, 2018, as part of the three rounds of the SAFT sale. Between Sep 2018 and Jan 2019, it spent at least 85 percent of these funds. To help accomplish this, it converted 86 percent of the ether into fiat. A total of 21,125 ether was reportedly converted into $3,493,023. This means that the SAFT sales raised a supposed total of $4,467,998 and 3,371.5 ether has not been converted into fiat. The total amount of the fiat currency spent is not given. It is only said that around 85 percent of the total funds raised were spent on partnerships, marketing, team, development, professional services, and miscellaneous purposes. It is also not specified if ether was spent to accomplish some of this. (This is only one of several examples where financial data appears to be absent.) It may be too early, however, to judge whether or not these funds have been mismanaged — though there are things which seem to suggest this to be a reasonable possibility.- There is no table to confirm the figures in the FET Token Release Schedule infographic.

- The infographic is divided in such a way as to make the derivation of statistical data difficult.

- Though the original token distribution table from Sep 2018 is included in the appendix, it is stated that the actual distribution differs from these figures. No updated table or data is offered.

NEM and Europe

Earlier this week, the 2018 NEM Foundation Council was scrutinized for the mismanagement of funds. If emergency funding is not approved by the community, the successful adoption of NEM (XEM) may be hindered by economic forces. It is not known yet if FET has similarly mismanaged funds, but it is known that a large portion of funds raised during the private sale has been spent — with little to show for it. Fetch and NEM are two of the four partners within the Blockchain for Europe association. The others are Ripple (XRP) and EMURGO/Cardano (ADA). If NEM or FET are unable to financially support their own projects and initiatives, the future of the Blockchain for Europe association may also be threatened. If both projects falter, then the success of the group project may come to rest primarily upon XRP or Cardano. The need for this association, however, may be redundant. After all, 27 European nations have already created the European Blockchain Partnership (EBP). The purposes of the EBP are to facilitate the creation of the European Blockchain Services Infrastructure (EBSP). The EBP and bodies of the European Union (EU) are separately developing and deploying blockchain-based services throughout Europe. Because these purposes are similar to those of the Blockchain for Europe association, the need for XRP, ADA, NEM, or FET to contribute to blockchain-based projects may be unnecessary.

Conclusion

BitTorrent Token (BTT) successfully launched on Binance Launchpad and was listed on the Binance exchange days later. FET’s private sale on Launchpad ended nearly six months ago and is still not listed on any exchange. Large amounts of currency have, nonetheless, been spent by Fetch executives without the release of any product. An updated roadmap suggests that there may be developments throughout 2019, but there are also signs that the mismanagement of funds may soon become a problem. This could threaten not only FET but also the stability of the Blockchain for Europe association. Do you think there is much to expect of Fetch.AI in the coming year or is it just another bad altcoin that scammed people out of their money? Let us know your thoughts in the comments below!

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored