In this episode of the BeInCrypto video news show, host Jessica Walker will address Bitcoin’s recent crash. We will look at its causes, including China’s recent crypto ban, and Tesla dropping bitcoin (BTC) payments, then discuss what could be next.

Bitcoin and crypto crash

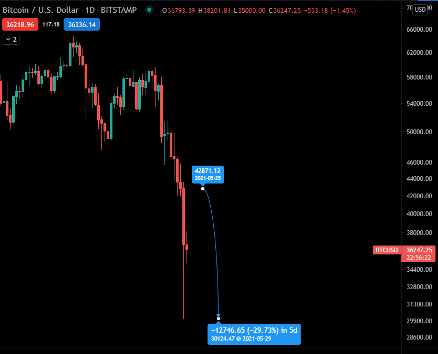

What started as a dip last week, after Tesla’s decision to no longer accept bitcoin as payment, has now turned into a crash. The most popular cryptocurrency and almost all others lost anywhere between 10% and 30% of their value in a space of 48 hours.

But the trigger for the meltdown yesterday came from a decision made in China. Chinese authorities ordered financial institutions and payment companies to cease providing services related to crypto transactions citing crypto’s speculative nature.

China ban

So what have authorities in China decided in its latest attempt to clamp down on what was a burgeoning market? Under the ban, institutions, including banks and online payments services, must not offer clients any service involving cryptocurrencies. This includes registration, trading, clearing, and settlements. People are still allowed to own crypto, but they can’t do anything with it now, with this ban in effect.

“Recently, cryptocurrency prices have skyrocketed and plummeted, and speculative trading of cryptocurrency has rebounded, seriously infringing on the safety of people’s property and disrupting the normal economic and financial order,” the statement said.

These were not Beijing’s first moves against digital currencies, though. In 2017, China shut down its local cryptocurrency exchanges, smothering a speculative market that had accounted for 90% of global bitcoin trading.

Tesla and bitcoin

This bad news for crypto adoption came in the wake of Elon Musk’s decision last week to stop Tesla accepting bitcoin as payment, and seems to have compounded its effect.

Elon did tweet that “Tesla had diamond hands” and wasn’t selling, but a quick check shows that the bitcoin price dropped to the level at which Tesla bought in.

The fall caused major crypto exchanges like Coinbase and Binance to temporarily go down, flooded with requests for withdrawals. Although strewn among them were probably some deposits from those that wanted to buy the dip.

What next?

This was the single largest daily candle on the bitcoin chart, decreasing 30% in a single day. And it’s fair to say that many people might be spooked right now.

It wasn’t the largest percentage move, but still, this is a huge change, especially with the rally that has been going on for so many months. We did see a quick rebound to $40,000, where we’re trading at the time of recording, and bulls will be looking at a critical level at $42,198, as a sign for a fast recovery.

But sharp moves in both directions are often followed by opposite whipsaw moves, so prepare yourselves for some more volatility.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.