Arbitrum (ARB) price has reclaimed the $1.20 zone after retracting at $1.16 on Tuesday. Despite recent price fluctuation, on-chain data reveals that Arbitrum whale investors have held firm. Can the heightened volatility and growing network activity validate the bullish ARB price prediction?

Arbitrum is an Ethereum scaling solution lauded for its optimistic roll-ups’ speed, scalability, and cost-efficiency. After a slow start to May 2023, the ARB network has gained considerable traction this week.

As the majority of ARB holders approach the break-even point, Arbitrum whales have held their positions in recent weeks. Here’s how the spike in network activity could spur another accumulation wave.

Arbitrum Whales are Holding Firm

Despite the recent ARB price fluctuations, whale investors on the Arbtirum network appear to be holding firms. The chart below shows how whales with balances of 1 million to 100 million ARB marginally increased their holdings in the last two weeks.

Specifically, between May 8 and May 18, they added 10 million coins to their 3.53 billion ARB aggregate balances.

At the current ARB market price of $1.20, the newly-added tokens are worth approximately $12 million.

The degree of influence that whale investors wield means that another accumulation wave among them could convince other strategic investors to become bullish themselves.

Network Traction is Growing

According to on-chain data, the number of active users on the Arbitrum network has spiked significantly this week. As illustrated in the chart below, the Daily Active Addresses on Arbitrum have nearly doubled compared to the figures recorded on May 13.

Between May 13 and May 18, the DAA surged 92% from 23,444 active users to 44,911.

The DAA metric evaluates the number of users carrying out transactions on a blockchain network by summing up the active unique wallet addresses interacting on a given day.

When the DAA spikes significantly, as observed above, strategic investors can deduce that the underlying technology is in high demand.

In summary, the rising DAA could be the critical bullish signal to prompt the ARB whales to start buying again.

ARB Price Prediction: $1.40 is Within Reach

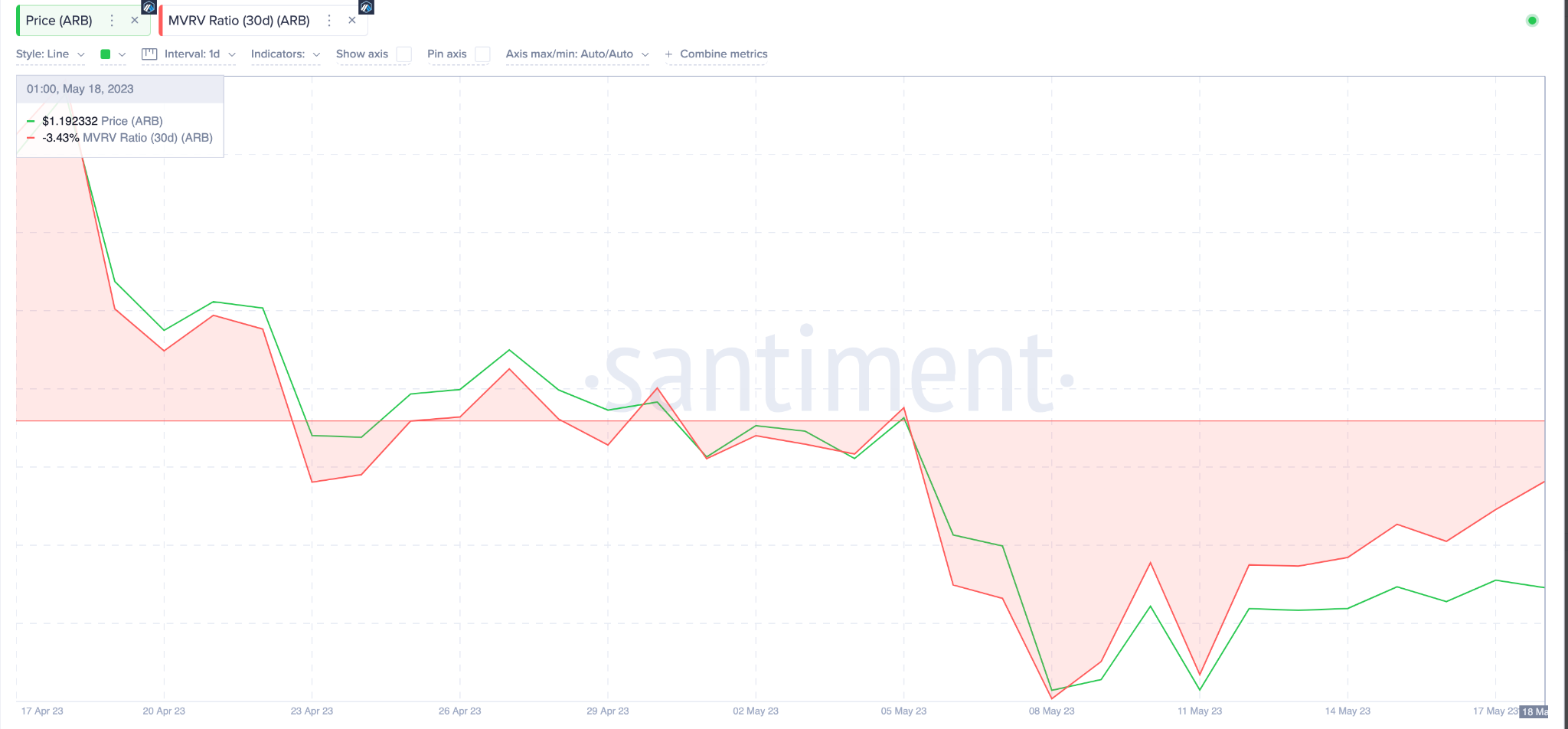

The Market Value to Realized Value (MVRV) ratio, which evaluates the financial position of current Arbitrum holders, suggests a rally toward $1.50 is the most likely ARB price prediction.

Notably, most crypto investors that bought ARB in the last 30 days could break even with another 3% surge to $1.25. This means that ARB could struggle to break above that resistance zone.

However, if the bullish Arbitrum price prediction plays out, historical data suggest ARB could rally toward $1.50 before hitting a major resistance.

In contrast, the bears could negate the bearish ARB price prediction if it drops below the previous local low of around $1.10.

However, at that zone, holders could stop selling in a desperate bid to keep their losses below 10%.

Nevertheless, if that $1.10 support does not hold as expected, the bears could push ARB below $1.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.