The global number of crypto holders soared by 34% in 2023, reaching a staggering 580 million by December, up from 432 million in January.

This growth trajectory, primarily led by Bitcoin (BTC) and Ethereum (ETH), marks a significant shift in the cryptocurrency market.

580 Million Cryptocurrency Holders Worldwide

A recent report by Crypto.com reveals that Bitcoin witnessed a 33% increase in its user base, growing from 222 million in January to 296 million in December. Interestingly, this surge accounts for 51% of the global crypto ownership.

“Crypto adoption in 2023 achieved new milestones, with the number of cryptocurrency owners reaching 580 million in spite of macro headwinds, namely the further monetary tightening by Western central banks to try to tame inflation, protracted kinetic conflict in Europe and a new one in the Middle East, and longer-term consequences of the pandemic,” Crypto.com analysts wrote.

The remarkable adoption rate of Bitcoin can be attributed to several pivotal developments. Key among these was the introduction of Bitcoin ETFs (exchange-traded funds) and the Bitcoin Ordinals protocol. The latter innovation enabled the minting of non-fungible tokens (NFTs) and fungible tokens directly on the Bitcoin network.

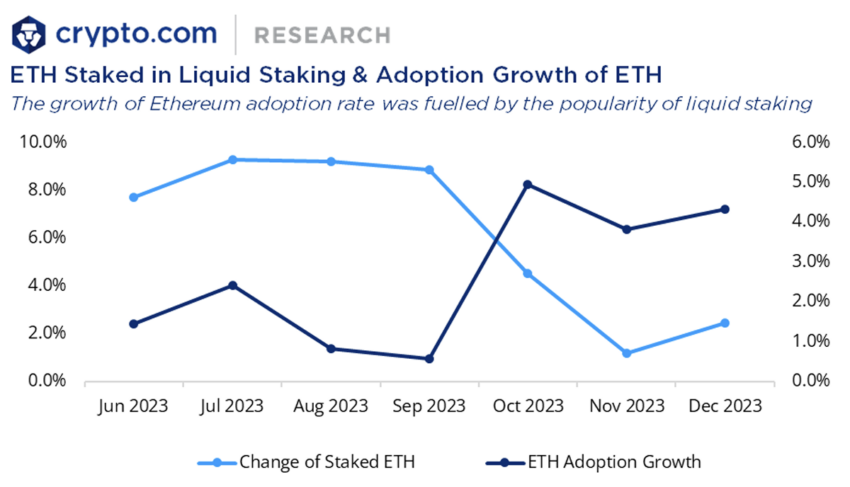

Ethereum, the second-largest cryptocurrency by market capitalization, was not far behind in its adoption rate. Indeed, its ownership grew by 39% and expanded from 89 million to 124 million in the same period, accounting for 21% of global crypto holders. The Ethereum Shanghai Upgrade primarily fueled this growth.

The upgrade facilitated liquid staking and allowed the withdrawal of staked ETH after the transition to a Proof-of-Stake (PoS) blockchain.

Driving Factors Behind Mainstream Adoption

An analysis of the 2023 crypto trends reveals that April and May were particularly buoyant months, with 5.1% and 6.7% growth rates, respectively. This uptick coincided with Ethereum’s Shanghai Upgrade on April 12, 2023.

ETH’s adoption growth was almost parallel to the changes in staked ETH. Indeed, liquid staking is still trending after the Shanghai Upgrade. Both BTC and ETH witnessed significant adoption rises in Q4 2023, spurred by Bitcoin and Ether ETFs developments.

Additionally, Bitcoin experienced a notable increase in interest in these months, likely due to the growing popularity of Bitcoin Ordinals. It saw more than 54 million inscriptions engraved on the Bitcoin network. These inscriptions generated fees exceeding 5,473 BTC, approximately $257 million.

The emergence of BRC-20 tokens also played a crucial role in Bitcoin’s Q4 growth. This was bolstered by the heightened interest from institutional investors with the launch of Bitcoin ETFs.

During this period, the prices of BTC and ETH experienced substantial surges, briefly reaching levels of $44,000 and $2,400, respectively.

Read more: Bitcoin Price Prediction 2024/2025/2030

The composition of cryptocurrency owners remained relatively stable, with shares of BTC and ETH remaining flat. The growth of the total number of cryptocurrency owners attributes to this. ETH’s adoption rate increased by 0.7%, while Bitcoin’s dropped slightly by 0.4% over the year.

This extraordinary growth in crypto ownership reflects a broader shift towards digital assets, attracting a diverse range of investors and enthusiasts worldwide.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.