The United States Federal Reserve is taking coordinated action with other central banks. The goal is to enhance liquidity provision via the standing U.S. dollar liquidity swap line arrangements.

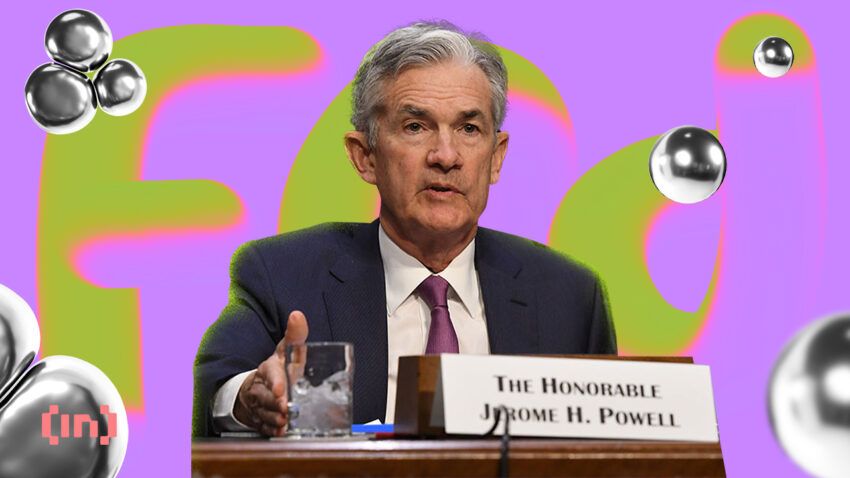

The United States Federal Reserve is taking more steps to help stabilize the economy, with the nation’s central bank coordinating action with other central banks. In a press release issued on March 19, the Federal Reserve stated that it was working with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank.

The goal is to “enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.”

Central banks currently offering U.S. dollar operations will increase the frequency of 7-day maturity operations from weekly to daily. The change will take place from March 20 and will continue at least until the end of April. The hope is that this will act as a liquidity backstop that will ease strains in global funding markets.

It’s another major move by the U.S. central bank, which has been dealing with a rough market and the crash of several notable banks. The interest rate hikes were a major talking point when they came up. With 2023 looking like a year of a possible recession, investors and analysts are going to keep a very close eye on the Federal Reserve’s actions and words.

Swap Lines Used During Tough Economic Periods

The use of international swap lines often happens during economically challenging periods. It was implemented following the 2008 recession and the COVID-19 pandemic. Central bank liquidity swaps are likely to peak again following the Fed’s announcement.

The closure of several banks, the retraction of the tech sector, and the threat of a global recession have every individual and company concerned.

At the moment, it’s hard to tell how global markets will play out — though crypto investors are celebrating the fact that Bitcoin is spiking during this crisis.

Uncertainty Aplenty in the Global Economy

BitMEX co-founder Arthur Hayes has explained his view on the decision, saying that it is “another way to bailout non-U.S. banks that isn’t obvious to the average person.”

His explanation of the situation is well worth reading, and his conclusion is, “Money Printer Go Brr!”

Some have said that swap lines are unrelated to quantitative easing and inflation, though others seem to disagree. Crypto enthusiasts are strongly focused on the impact these decisions will have on the crypto market.

Messari CEO Ryan Selkis believes that the banking crisis and general economic conditions will help boost Bitcoin prices. His prediction is that Bitcoin could reach $100,000 within the next twelve months as a result of current macroeconomic conditions, though he clarifies that this is a best-case scenario.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.