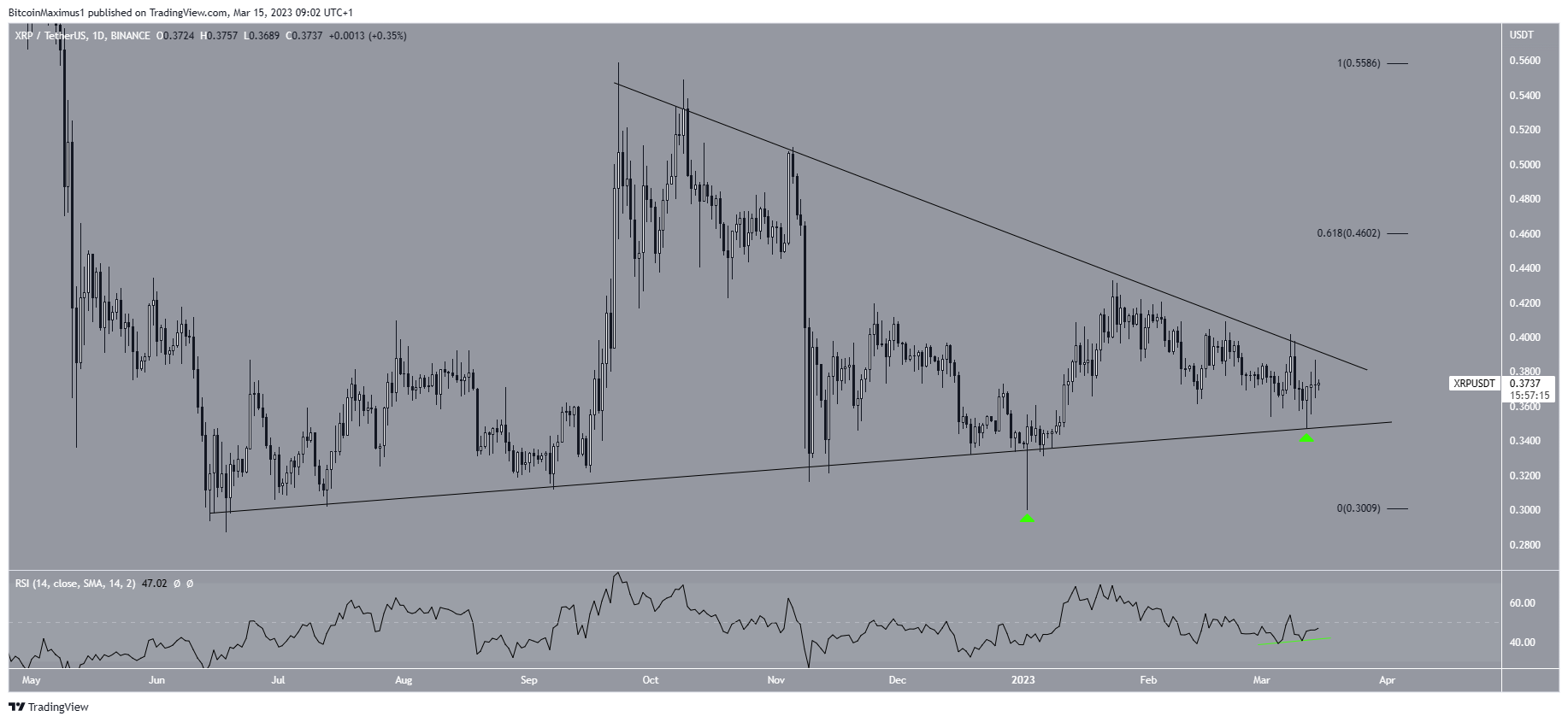

The Ripple XRP price trades very close to a crucial resistance area and could soon break out from it.

The XRP price has traded inside a long-term symmetrical triangle since June 2022. While the support line has been in place since this time, the resistance line began in September of the same year.

While the triangle is considered a neutral pattern, the movement inside it is bullish. The main reason for this is the creation of two bullish hammer candlesticks (green icons), on Jan. 2 and March 12, respectively. The first one led to a significant upward movement, and the second one may do the same.

If the Ripple price breaks out, the next closest resistance would be at $0.46. On the other hand, a breakdown from the triangle’s support line could lead to a fall toward $0.30.

The daily RSI also supports the possibility of a breakout since it has already generated bullish divergence (green line).

Besides the price action, it is worth mentioning that there is no news regarding the Securities and Exchange Commission (SEC) vs. Ripple Labs case.

Ripple XRP Price Corrective Structure Could Catalyze Breakout

The technical analysis from the short-term six-hour chart shows that the XRP token price trades in a descending parallel channel. Such channels usually contain corrective structures, meaning that a breakout from it would be likely. This aligns with the readings from the daily time frame. The fact that the price is in the upper portion of the channel makes a breakout more likely.

A breakout from the short-term channel would also mean that the digital asset broke down from the long-term triangle. As a result, it would confirm the downward movement toward $0.30. The breakout could occur in the next 24 hours if the ongoing increase continues.

To conclude, the most likely XRP price forecast is a breakout from the long-term triangle and an increase toward $0.46. On the other hand, a fall below the triangle’s support line could lead to a decrease toward $0.30.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.