The CEO of Tether Jean-Louis van der Velde’s has deleted his Twitter account following a Bloomberg report questioning the firm’s backing of its reserves. Tether has responded, calling the report misleading and saying USDT is fully backed.

Tether’s CEO has deleted his Twitter account following a recent Bloomberg report. The article makes several claims, including that Tether owes billions to Chinese investors. The outlet said that it had obtained documents showing an account of Tether Holdings’s reserves, which include “billions of dollars of short-term loans to large Chinese companies.”

The report primarily addresses the issue of Tether’s reserves backing its billions of USDT, something which has been a serious point of contention in the past. Among other things, it claims that Tether holds billions in commercial papers from large Chinese firms and that these are being used to back up its reserves.

Tether’s response to the article was scathing, calling out Bloomberg for using questionable sources to “fit a pre-packaged and pre-determined narrative.” Tether has taken steps in the past 12 months to offer some proof of its reserves. It has released some attestations of its reserves, though some investors in the market don’t believe that this is enough to quell the concerns.

Bloomberg had previously reported that the Department of Justice was investigating Tether executives for bank fraud. As the market’s biggest stablecoin, any impact on Tether could spill over to the rest of the market. This is a concern that has been discussed time and again in the past.

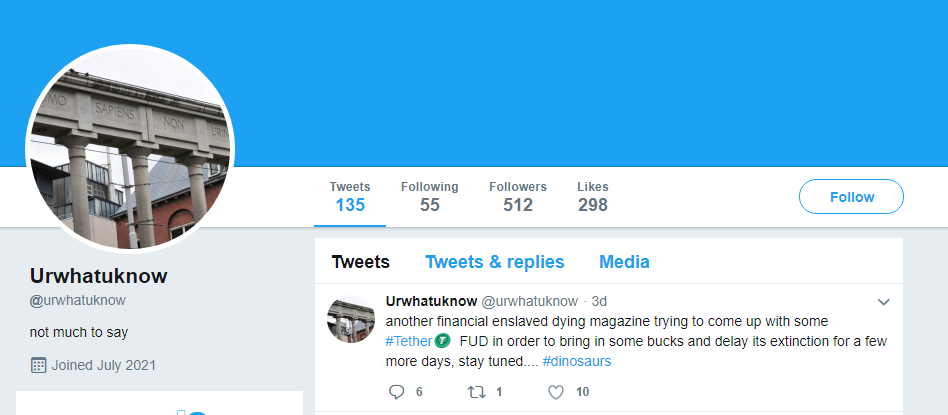

As for the CEO’s final tweet, it said that “[A]nother financial enslaved dying magazine” was coming up with “FUD” and to “stay tuned,” which could be interpreted in myriad ways.

Could the SEC also be investigating Tether?

There has been no official notice from the SEC suggesting an investigation. However, should such a development happen, the market would get a much deeper insight into the backing of Tether’s reserves.

There have been claims from other outlets that Tether holds Evergrande’s commercial papers, which Tether denies. Such pressure could be the breaking point of the company, which looks likely to face action after years of scrutiny from both investors and media outlets.

Social media platforms are all having heated discussions about this development. Many crypto investors have in the past criticized Tether for being opaque about its backing and are eager to see what an SEC investigation might bring to light.

The SEC has hinted at an examination of Tether after the Freedom of Information Act (FOIA) indicated the same. As for the Department of Justice probe related to bank fraud, the firm called these “stale claims.” The rising number of such reports and responses understandably do not give investors much confidence, but it remains to be seen how this will develop.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.