Bitcoin ETFs have been talked about since at least 2017 and it sometimes feels like we’re never going to get one. However, we must not forget that the first BTC exchange-traded fund will open the floodgates to new investments like never before.

The U.S. Securities and Exchange Commission (SEC) has postponed and rejected many Bitcoin ETF applications, so far. Just this month, the regulatory body postponed the decision for three BTC-related ETFs.

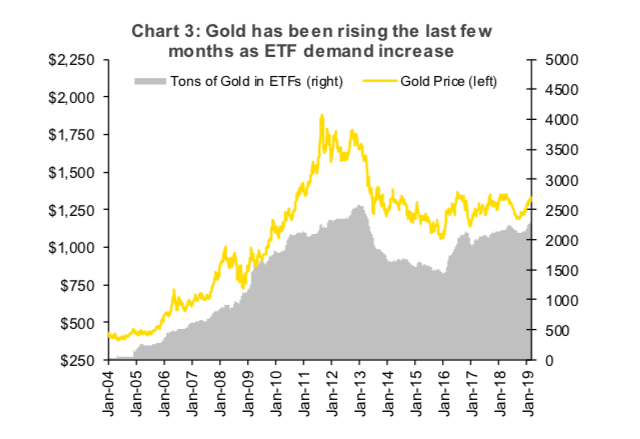

The impact that gold ETFs had on the price of that precious metal was significant. Gold ETFs fundamentally transformed the market. In 2010, it was recorded that 2,062.6 tonnes of gold were in vaults to physically back these ETFs.

One can easily imagine the potential Bitcoin ETFs would bring, given that Bitcoin is just a tiny fraction of gold’s market capitalization.

What a Bitcoin ETF Would Bring

The issuing of the first Bitcoin ETF would allow for many structural benefits to take root and likely expand the entire cryptocurrency industry tremendously. Here are the top five benefits such a fund would bring.Transparent Holdings

A Bitcoin ETF is unique because every fund needs to be physically-backed. This means, naturally, that less Bitcoin is in circulation and is instead in cold-storage. Overall, it allows for upward price pressure and transparency.Daily Proof of Reserves

With us expecting exchanges to prove their reserves unilaterally, institutional funds like an ETF would allow for compliant proofs. We will know exactly how much Bitcoin is stored in a given fund, which is needed to gain public trust.Investor Protections

Traditional investors are still hesitant about Bitcoin, despite it demonstrating incredible reliance in the past year. A Bitcoin ETF would help ease their nerves and also protect investors from potential fraud.New Money Would Pour In

If you want an idea of how a Bitcoin ETF would affect the market, look no further than the consequences of the first gold ETF. Since 2004, the price of gold has exploded with more and more of the precious metal being locked up to back the growing demand.

Proper Tax Documentation

As of now, figuring out taxes when it comes to cryptocurrencies is complicated. In the United States, even crypto-to-crypto transactions are taxed. With a Bitcoin ETF, traditional investors can calculate their taxes simply. Moreover, the legitimization of Bitcoin would put further pressure on tax agencies to clarify their existing frameworks.

Bring in the Institutional Money

It’s hard to overstate how much of an impact the first Bitcoin ETF will bring in legitimizing the leading cryptocurrency. Institutional money is already slowly entering the industry, but an approved ETF would be an altogether new paradigm. If Bitcoin is to enter the financial world as a respectable asset, it has to eventually win an ETF approval — and, as Bitcoin continues to mature over time, the more likely it is that it will someday gain that much-needed approval. Do you agree that a Bitcoin ETF will happen in due time? What other benefits would an ETF bring? Let us know your thoughts in the comments below. And if you would like to buy Bitcoin right now on a safe exchange with the lowest fees, click here to sign up on StormGain with only an email address!

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Anton Lucian

Raised in the U.S, Lucian graduated with a BA in economic history. An accomplished freelance journalist, he specializes in writing about the cryptocurrency space and the digital '4th industrial revolution' we find ourselves in.

Raised in the U.S, Lucian graduated with a BA in economic history. An accomplished freelance journalist, he specializes in writing about the cryptocurrency space and the digital '4th industrial revolution' we find ourselves in.

READ FULL BIO

Sponsored

Sponsored