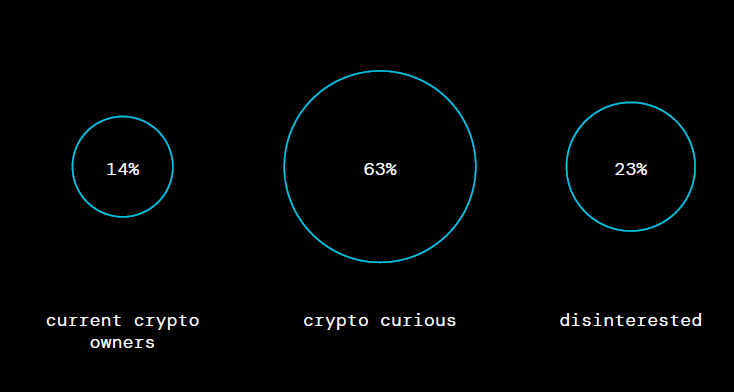

Gemini has published a State of Crypto report for 2021, noting that over 50% of crypto-curious investors are women, and roughly 14% of the US population holds cryptocurrency.

New York-based exchange, Gemini, has released the State of Crypto report for 2021, providing several indicators of how the market is trending in the US. The survey involved 3,000 investors and consumers who were questioned between October and November 2020.

In the introductory section, Gemini notes that the arrival of institutions and companies like PayPal and MicroStrategy have put crypto on the radar. The report says that activity from potential investors is set to increase, with a wider range of demographics likely.

Broadly, the survey examined the profile of current and potential investors, popular assets, knowledge level, and faith in it. Interestingly, more than 50% of those surveyed said that they wanted to know more about cryptocurrencies.

However, 53% of the investors who were “crypto-curious” were women. The average age of this group was 44 years old, with the average age of current investors being 38. This unique demographic is what spurs Gemini to say that the average crypto holder may take on a different face soon.

Unsurprisingly, the most popular age group in the crypto space is millennials and, to a lesser degree, Gen Z. It notes that 14% of the US population owns cryptocurrencies, which is a remarkably large amount. This level of growth indicates that crypto is on the cusp of transitioning into the mainstream.

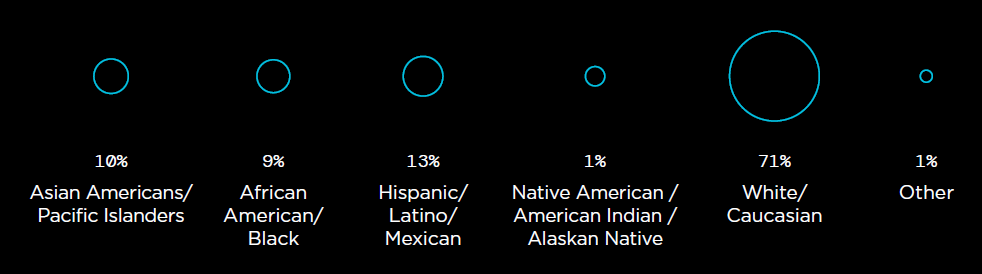

Among ethnic groups, crypto was most popular among Caucasians. However, Hispanics and Asian Americans/Pacific Islanders come far behind, with under 15% each. This, too, shows a changing nature in the demographics.

Bitcoin remains the most well-known asset, says Gemini

There is some variance when it comes to the knowledge of crypto assets by investors and those interested in the market. 95% of those surveyed said they were aware of bitcoin, but only 38% were aware of ethereum. Bitcoin cash followed at 24%, and litecoin at 16%.

After pointing out the average knowledge of US adults, Gemini states that education is important to convert “crypto-curious consumers…to actual crypto holders” — which it is working on as well. 60% of the crypto-curious said that they were not very knowledgeable about crypto.

Bitcoin’s popularity stems from the fact that it has become a byword for cryptocurrencies. The oldest cryptocurrency has made a name for itself in the years since its creation, and it is only now that it has attracted broad retail attention.

Unlike the 2017 bull run, the current bull run has the support of institutions and major companies. This has lent it some legitimacy, and retail investors have gained more confidence in it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.